When the economy falls, most people freeze.

The wealthy move.

Every major fortune in American history was built during moments of fear—recessions, crashes, and downturns when prices were low and competition was scared. Economic downturns don’t destroy wealth. They transfer it.

The question isn’t whether opportunity exists.

The question is who is positioned to act.

Assets don’t disappear in downturns.

They get discounted.

When markets fall:

- Real estate prices soften

- Stocks trade below intrinsic value

- Businesses sell equity cheaper

- Sellers accept terms they wouldn’t touch in good times

This is why the wealthy say, “Buy when there’s blood in the streets.”

Not because they celebrate pain—but because pricing reflects emotion, not value.

2. The Assets That Matter Most During Downturns

Not everything is worth buying just because it’s cheaper. Focus on assets that recover and compound.

High-Priority Assets:

- Real Estate: Rental properties, small multifamily, land

- Stocks: Cash-flowing companies, index funds, dividend payers

- Businesses: Service businesses with recurring demand

- Intellectual Property: Brands, content, digital assets

Wealth is built by acquiring productive assets, not collectibles.

3. Cash Positioning Is the Real Advantage

Downturns reward liquidity.

Wealthy buyers prepare before crashes by:

- Keeping emergency reserves

- Reducing bad debt

- Holding cash or cash equivalents

- Securing credit while times are good

This allows them to act without panic.

Cash doesn’t make you rich—but it lets you buy things that do.

4. Why Credit Access Separates Buyers From Spectators

In downturns, banks tighten lending for most people—

but extend favorable terms to strong borrowers.

That’s why credit preparation matters:

- Low utilization

- Clean payment history

- Multiple trade lines

- Established banking relationships

Credit is leverage.

And leverage, used correctly, multiplies opportunity.

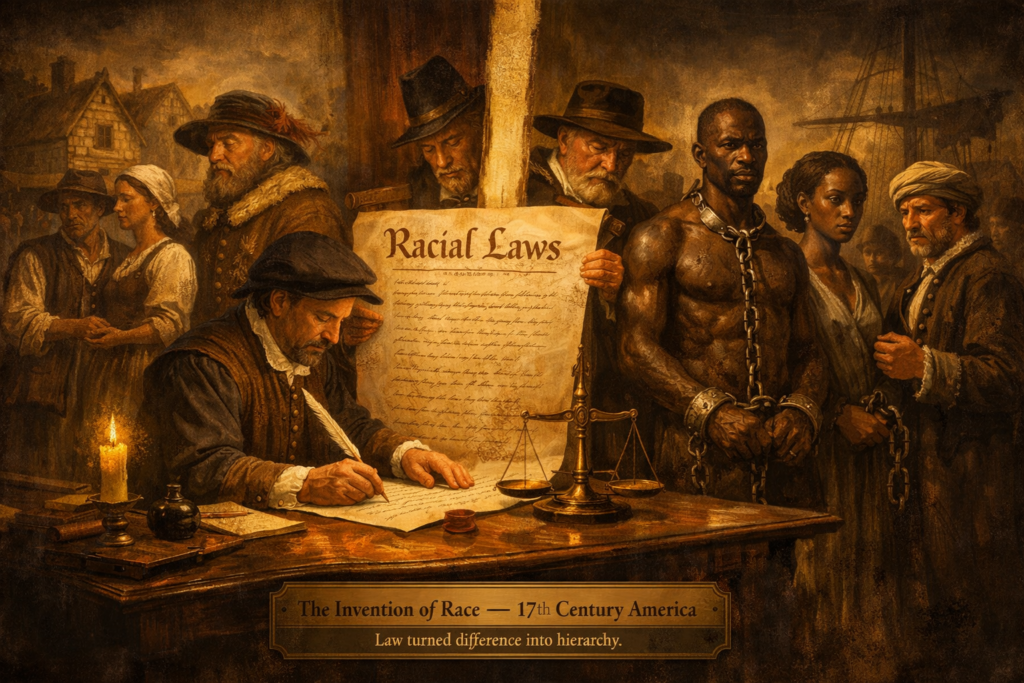

5. The Historical Pattern Black Families Must Understand

History is clear:

- Assets were cheap after every crisis

- Ownership expanded for those who bought

- Wealth gaps widened for those who waited

From land after the Civil War…

to housing after 2008…

to stocks after 2020…

The tragedy wasn’t lack of opportunity.

It was lack of access, preparation, and education.

That’s changing now.

6. Ownership Beats Income Every Time

Jobs pay bills.

Ownership builds balance sheets.

During downturns:

- Income feels uncertain

- Assets quietly appreciate over time

- Rent still gets paid

- Dividends still flow

This is why wealthy families prioritize what they own, not just what they earn.

7. What Stops Most People From Buying When It Matters

The barriers are rarely financial. They’re psychological.

Common blockers:

- Fear of headlines

- Waiting for “perfect timing”

- Overconsumption during good years

- Lack of long-term planning

The market doesn’t reward confidence.

It rewards preparation.

8. A Simple Wealth-Building Playbook for Downturns

You don’t need perfection. You need structure.

- Stabilize cash flow

- Eliminate toxic debt

- Secure credit early

- Identify 1–2 asset classes

- Buy with margin of safety

- Hold long-term

Repeat this cycle across generations—not quarters.

9. Why This Moment Matters More Than Most

America has entered a period of:

- Asset repricing

- Institutional buying

- Population shifts

- Infrastructure changes

These windows don’t stay open long.

Those who move now build foundations.

Those who hesitate pay premiums later.

Final Thought

The wealthy don’t wait for certainty.

They wait for value.

Economic downturns don’t signal the end of opportunity.

They announce its arrival—quietly, briefly, and without warning.

Those who understand this build legacies.

Those who don’t fund them.

❤️ Support Independent Black Media

Black Dollar & Culture is 100% reader-powered — no corporate sponsors, just truth, history, and the pursuit of generational wealth.

Every article you read helps keep these lessons alive — lessons they never wanted us to learn.

Focus Keyphrase: Black Americans build generational wealth during economic downturns

Slug: how-black-americans-build-generational-wealth-economic-downturns

Meta Description: Learn how Black Americans can build generational wealth by buying assets during economic downturns, when prices are lower and long-term opportunities are greatest.