Most people think life insurance is about death.

The wealthy know it’s about control.

An ILIT — Irrevocable Life Insurance Trust — is one of the most powerful wealth-preservation tools in existence, yet most families never hear about it until it’s too late… usually at a funeral, right before the government shows up with its hand out.

This isn’t theory.

This is how dynasties protect money, avoid estate taxes, and pass wealth cleanly — without begging the system for permission.

🎥 Watch This First

(This short video explains why ILITs are one of the most misunderstood — and most powerful — tools for generational wealth.)

Go Deeper:

This article explains what an ILIT is.

My ILIT Blueprint eBook walks you through how to structure one, avoid costly mistakes, and use life insurance as a private family bank.

👉 Get the ILIT Blueprint here https://stan.store/blackdollarandculture/p/get-your-family-wealth-trust-blueprint-now

1. What an ILIT Actually Is (Plain English)

An ILIT is a legal trust that owns your life insurance policy instead of you.

That one shift changes everything.

When the trust owns the policy:

- The death benefit is removed from your taxable estate

- Creditors and lawsuits can’t touch it

- Probate is bypassed entirely

Translation:

The money skips the government’s toll booth and goes straight to your family.

2. Why the Wealthy Use ILITs (And Most People Don’t)

Here’s the quiet truth no one explains clearly:

Life insurance payouts can become taxable if you own the policy yourself.

When you do:

- The payout may be counted as part of your estate

- Estate taxes can claim up to 40%

- Probate delays access

- Courts and confusion get involved

When an ILIT owns the policy:

- The payout is not your asset

- Estate taxes are avoided

- Probate is eliminated

- Distribution happens privately

This is why wealthy families don’t “hope things work out.”

They design outcomes.

If you want the exact structure wealthy families use, the full breakdown is inside my ILIT Blueprint eBook.

👉 Access the ILIT Blueprint https://stan.store/blackdollarandculture/p/get-your-family-wealth-trust-blueprint-now

3. How an ILIT Works (Step-by-Step)

Here’s the clean breakdown:

- You create the ILIT

An estate attorney drafts the trust. - A trustee is appointed

Someone other than you controls the trust. - The trust purchases the life insurance policy

Or receives an existing one (with strict timing rules). - You fund the trust annually

Usually through tax-free gift exclusions. - The trust pays the insurance premiums

- Upon death, the trust receives the payout

And distributes funds according to your instructions.

No probate.

No estate tax exposure.

No chaos.

Important: Most ILIT failures happen during setup.

The ILIT Blueprint eBook explains trustee selection, funding rules, and the three-year lookback, so you don’t accidentally destroy the benefits.

👉 Download the ILIT Blueprint https://stan.store/blackdollarandculture/p/get-your-family-wealth-trust-blueprint-now

4. Why “Irrevocable” Is the Price of Power

“Irrevocable” scares people because it means:

- You can’t change your mind later

- You can’t reclaim the policy

- You give up direct control

But that’s exactly why it works.

The IRS only respects separation when it’s real.

No loophole cosplay. No fake distancing.

You trade flexibility for protection — and wealthy families make that trade gladly.

5. ILIT vs Naming a Beneficiary (This Is Where People Lose Wealth)

Naming a beneficiary feels responsible.

Using an ILIT is strategic.

With only a beneficiary:

- Estate taxes may apply

- Probate can delay funds

- Creditors may intervene

- Money often arrives with no structure

With an ILIT:

- Estate taxes are avoided

- Probate is bypassed

- Assets are protected

- Distributions follow rules, not emotions

One is convenient.

The other is built to last generations.

6. How ILITs Create Generational Wealth (Not Just a Payout)

An ILIT isn’t just about receiving money — it’s about how money is released.

You can design rules like:

- Age-based distributions

- Education-only payments

- Business startup funding

- Emergency-only access

- Lifetime income streams

That prevents wealth from disappearing the moment emotions run high.

Wealth without structure disappears.

Wealth with structure multiplies.

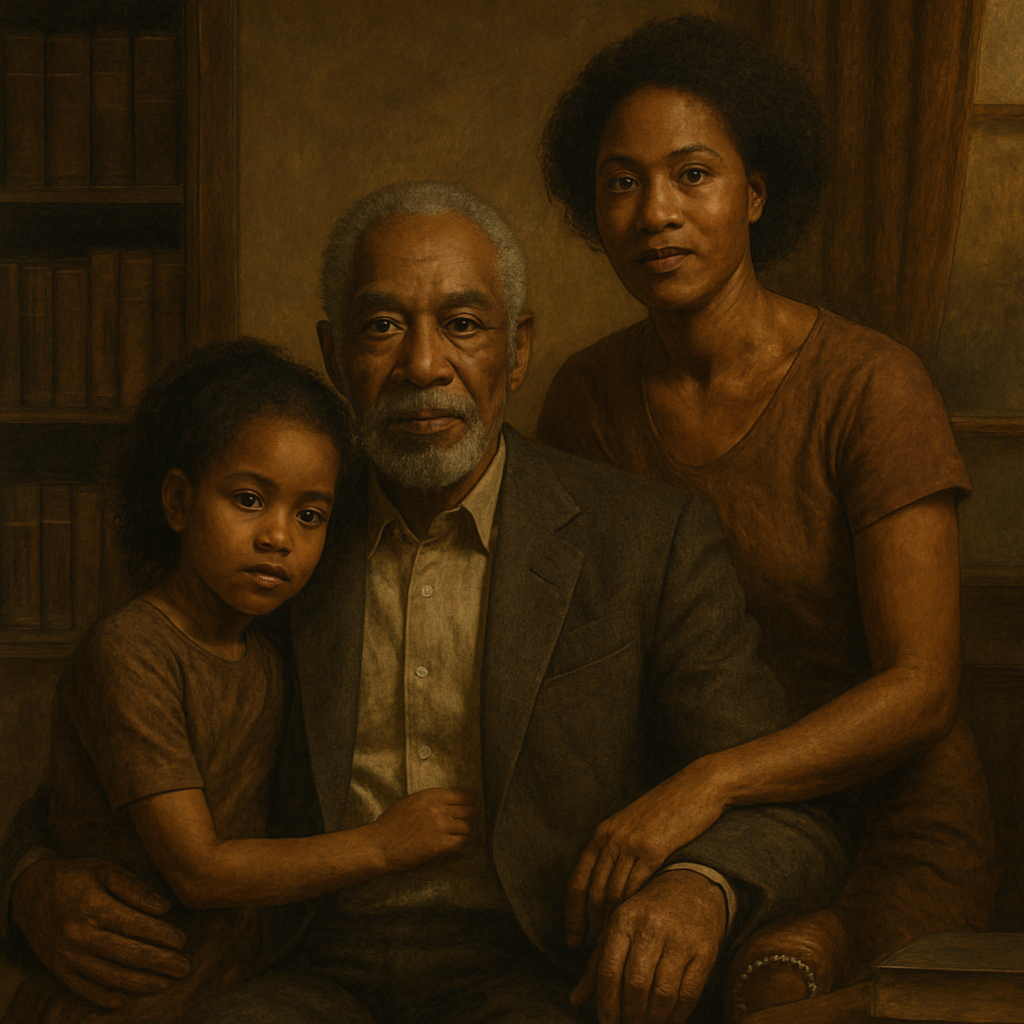

7. Why ILITs Matter Especially for Black Families

Let’s be honest.

More Black wealth is lost to:

- Probate delays

- Poor planning

- Funeral expenses

- Family disputes

- Government intervention

…than to bad investments.

An ILIT does something radical:

It turns life insurance into a private family bank, not a public transaction.

No courtrooms.

No GoFundMe funerals.

No confusion about “who gets what.”

Just execution.

This is why I created the ILIT Blueprint — to help families stop reacting and start building financial infrastructure.

👉 Get the ILIT Blueprint here https://stan.store/blackdollarandculture/p/get-your-family-wealth-trust-blueprint-now

8. Who Should Seriously Consider an ILIT

You should consider an ILIT if:

- Your estate may grow over time

- You own a business

- You want to protect children or grandchildren

- You care about tax efficiency

- You value legacy over convenience

This isn’t just for the wealthy.

It’s for the intentional.

9. Common ILIT Mistakes to Avoid

Avoid these at all costs:

- Naming yourself as trustee

- Funding the trust incorrectly

- Violating the three-year rule

- Using cheap templates

- Not coordinating with an estate plan

An ILIT done wrong is expensive paperwork.

An ILIT done right is a fortress.

Final Thought (Read This Twice)

The wealthy don’t ask:

“How much life insurance do I need?”

They ask:

“Who controls the money when I’m gone?”

An ILIT answers that question before emotions, courts, or taxes get involved.

That’s not insurance.

That’s power.

Want the playbook?

If this article changed how you think about life insurance, the ILIT Blueprint eBook shows you how to turn knowledge into action.

👉 Secure the ILIT Blueprint https://stan.store/blackdollarandculture/p/get-your-family-wealth-trust-blueprint-now

❤️ Support Independent Black Media

Black Dollar & Culture is 100% reader-powered — no corporate sponsors, just truth, history, and the pursuit of generational wealth.

Every article you read helps keep these lessons alive — lessons they never wanted us to learn.

Focus Keyphrase: ILIT Irrevocable Life Insurance Trust

Slug: what-is-an-ilit-irrevocable-life-insurance-trust

Meta Description: Learn what an ILIT (Irrevocable Life Insurance Trust) is, how it works, and why wealthy families use it to avoid estate taxes, protect assets, and build generational wealth.