How to Start an Emergency Fund (Beginner Guide)

Most people don’t fall into financial trouble because they’re reckless.They fall because life happens. A tire blows out on the highway.Hours get cut at work.A child gets sick.Rent goes up.The car refuses to start on Monday morning. And suddenly a small inconvenience becomes a financial emergency. Here’s the truth many households discover too late: The problem isn’t the emergency.The problem is being unprepared for it. That’s where an emergency fund changes everything. It turns panic into inconvenience.It turns stress into strategy.It gives you breathing room while everyone else is gasping for air. Let’s build yours step by step. What Is An Emergency Fund? An emergency fund is money set aside ONLY for unexpected, necessary expenses. Not vacations.Not shoes.Not a concert. We’re talking about: If it’s not urgent and unexpected, it doesn’t qualify. This money is your financial shock absorber. Why Beginners Must Start Here First Before investing.Before flipping houses.Before crypto.Before options. You need stability. Without a cushion, every surprise gets put on a credit card…and debt quietly becomes the thief of your future wealth. An emergency fund protects your:✔ Credit score✔ Investments✔ Peace of mind✔ Ability to make calm decisions No drama. No desperation. Step 1: Your First Goal → $1,000 Forget six months of expenses for now. Your first mission is simple:stack your first $1,000 as fast as possible. Why? Because most small emergencies fall under that number. And once you hit it, something powerful happens… You start moving different.You feel in control.You breathe easier. Confidence is built through wins. Step 2: Where Should You Keep It? Your emergency money should be: ✅ Safe✅ Easy to access✅ Separate from daily spending Good places include: Not under the mattress.Not invested in stocks.Not tied up where it can lose value. This is protection money, not growth money. Step 3: How Much Do You Eventually Need? After you reach $1,000, level up to: 👉 3–6 months of living expenses. If your monthly bills are $3,000, your target becomes: This is the number that protects families from layoffs, illness, or major life disruptions. Step 4: How To Build It Faster Most people think they can’t save. But usually, money is leaking quietly. Try this: Speed matters. The faster you build it, the faster stress leaves your life. Step 5: Automate Your Discipline Willpower fades. Systems win. Set up automatic transfers every payday — even if it’s only $25 or $50. You’re not trying to be impressive.You’re trying to be protected. Small deposits create big security over time. What Happens When You Finally Have One Something amazing changes. You stop fearing the mail.You stop dreading unknown numbers calling.You stop living on edge. You gain power. Because emergencies no longer control you. You control them. The BD&C Truth About Wealth Most people chase visible wealth. Nice cars.Designer clothes.Status. But real wealth often starts invisibly. In quiet accounts.In boring savings.In preparation. Because when storms hit, the prepared keep moving forward while others start over. If nobody ever taught you this, now you know. Start small.Stay consistent.Protect your household. Your future self will thank you. #EmergencyFund #RainyDayMoney #FinancialSecurity #BlackWealth #GenerationalWealth #MoneyBasics #WealthBuilding #BDandC Focus Keyphrase: how to start an emergency fundSlug: how-to-start-an-emergency-fundMeta Description: Learn how to start an emergency fund step by step. A beginner-friendly guide to building financial security, avoiding debt, and protecting your future. They never told us that peace of mind has a price — and it’s usually saved a little at a time. An emergency fund is more than money; it’s dignity, choice, and the power to say “we’ll be okay.” Start yours today, build it brick by brick, and watch how differently you walk through the world tomorrow. Read more and take control at Black Dollar & Culture.

When America Is in Debt, Ownership Is the Escape Plan

When a nation owes more than it owns, history begins to whisper. There is a moment in every empire’s life when the numbers stop being numbers and start becoming signals. Signals of strain. Signals of fragility. Signals that the ground beneath everyday people is slowly, quietly shifting. The screens still glow. The markets still open. Politicians still promise. But beneath the performance, the ledger is bleeding. And for families without ownership, that bleeding eventually reaches the doorstep. Because when governments drown in debt, they rarely sink alone. They inflate.They tax.They cut.They print.They postpone. But they do not protect you. This is the part they never teach in school, never advertise in campaign speeches, never explain during the evening news. Debt at the top changes life at the bottom. The question is never whether a reckoning comes. The question is who is prepared when it arrives. In times like these, there are always two kinds of people. The dependent and the positioned. The dependent wait. They hope the job holds. They pray prices settle. They assume retirement accounts will recover. They trust systems designed by people who already moved their money. The positioned study patterns. They understand that currency weakens when printing strengthens. They recognize that assets behave differently than wages. They know that ownership absorbs shock while dependency multiplies it. And they move early. Long before panic becomes policy. If you listen carefully, history has run this lesson before. When Rome stretched itself beyond sustainability, elites secured land while citizens received promises.When currencies faltered in Latin America, those with businesses survived while savers were erased.When inflation burned through the 1970s, hard assets outran paychecks. Different centuries.Same story. When the system is stressed, ownership becomes oxygen. Everything else becomes hope. But here is where this becomes personal. For generations, many families were kept from acquiring the very tools that provide insulation during unstable times. Access denied. Loans rejected. Districts redlined. Knowledge hidden behind walls of jargon. The result was predictable. When turbulence comes, those without assets feel it first and longest. So what do you do when the largest economy in the world keeps adding zeros to a bill nobody can realistically repay? You stop playing defense. You start building position. You convert fragile income into durable assets. You prioritize businesses that can raise prices with inflation.You learn how real estate transfers cost to tenants.You understand why equity in productive companies historically survives currency cycles.You build private systems of lending inside families.You turn consumers into shareholders. You become harder to shake. Because the uncomfortable truth is this: Governments respond to debt with policies.Owners respond to debt with strategy. And strategy travels through bloodlines. Some people will read headlines and freeze. Others will read balance sheets and prepare. This is not about fear. Fear paralyzes. This is about awareness. Awareness sharpens. A country carrying enormous debt will make decisions to maintain stability. Some of those decisions help markets. Some hurt workers. Some protect banks. Some dilute savers. But almost all reward ownership. That pattern is as old as finance itself. The people who understand it quietly rearrange their lives. They buy instead of rent.They invest instead of store cash.They create income streams instead of relying on one.They study policy the way farmers study weather. Because storms are inevitable. Preparation is optional. And once you see the pattern, you cannot unsee it. You begin to recognize why the wealthy rush into assets during uncertainty.Why institutions accumulate land.Why smart money prefers control over promises. They are not guessing. They are positioning. So the real conversation is not “Is America in debt?” The real conversation is, “Are we building protection faster than the system is building pressure?” That answer determines comfort or crisis for the next generation. Families who move early will look calm later. Families who wait will wonder what happened. And somewhere in the future, children will ask what decisions were made when the warning signs were visible. They will live inside the answer. History is generous with clues. It is ruthless with excuses. The debt may be national. But preparation is personal. Move accordingly. Focus Keyphrase: America in debt wealth strategyMeta Description: America’s rising national debt is a warning signal. Learn how families can protect themselves through ownership, assets, and generational wealth positioning.Slug: america-in-debt-wealth-strategy

The Safest Place to Keep Your Money During a Crisis

When a crisis hits — recession, banking panic, market crash, political chaos — the first instinct people have is to move fast. Pull money out. Hide cash. Chase whatever feels “safe” at the moment. That instinct has ruined more wealth than the crisis itself. The truth is uncomfortable, but powerful:There is no single “safe place” for money during a crisis. There is only a safe strategy. And the people who come out stronger aren’t the ones who panic — they’re the ones who prepared before the storm. Let’s walk through where money actually survives, grows, and stays accessible when systems get stressed. What “Safe” Really Means in a Crisis Before we talk locations, we need to define safety properly. During a crisis, “safe” does not mean: Safe means three things: Any place your money lives should satisfy at least two of the three. The strongest setups hit all three. 1. Insured High-Yield Cash (Your First Line of Defense) Despite the noise, cash is still king during uncertainty — when it’s parked correctly. Money held in FDIC-insured institutions remains one of the most reliable anchors during turmoil. Federal Deposit Insurance Corporation Why this works Where people mess up BD&C rule:Cash is not for growth — it’s for control. 2. U.S. Treasury Assets (Quiet, Boring, Powerful) When fear hits global markets, institutions don’t panic — they run to U.S. Treasuries. U.S. Department of the Treasury Treasury bills, notes, and money-market funds backed by Treasuries are considered some of the safest financial instruments in the world. Why this works What this isn’t This is storm shelter money — not party money. 3. Diversified Brokerage Accounts (Not Just Savings) Many people think crisis safety means “pull everything out.” Wealthy families do the opposite — they spread exposure. A well-structured brokerage account holding: creates controlled risk, not chaos. Why this works The danger isn’t investing during a crisis —it’s being forced to sell because you didn’t plan liquidity. 4. Hard Assets That Don’t Depend on Banks When trust in systems drops, tangible value matters. That includes: Gold isn’t magic — but it has survived: Why this works BD&C reminder:Hard assets protect wealth between generations — not just between paychecks. 5. The Most Overlooked “Safe Place”: Structure Here’s the part most people skip — and pay for later. The safest money isn’t just where it’s kept.It’s how it’s owned. Families that survive crises often use: Why? Because structure protects against: Money without structure is fragile — no matter where it sits. What Not to Do During a Crisis Let’s be clear. ❌ Don’t pull everything into physical cash❌ Don’t chase “guaranteed” returns❌ Don’t move money based on fear headlines❌ Don’t trust platforms you don’t understand Crises punish speed without strategy. The Real Answer No One Wants to Hear The safest place to keep your money during a crisis isn’t a bank, vault, or asset. It’s a system: That’s how wealth survives storms — and why some families quietly come out richer every time. ❤️ Support Independent Black Media Black Dollar & Culture is 100% reader-powered — no corporate sponsors, just truth, history, and the pursuit of generational wealth. Every article you read helps keep these lessons alive — lessons they never taught us, but always used. If this helped you think differently about safety, share it with someone who’s still being told to “just save more.”We don’t need fear.We need frameworks. Ownership over panic.Structure over noise.Strategy over luck. Focus Keyphrase: safest place to keep your money during a crisisSlug: safest-place-to-keep-your-money-during-a-crisisMeta Description: Learn where to safely keep your money during a financial crisis using a proven wealth strategy that prioritizes protection, liquidity, and long-term stability.

How to Invest in ETFs for Beginners (Step-by-Step)

Most people don’t avoid investing because they’re lazy.They avoid it because Wall Street made it sound complicated on purpose. Charts, jargon, talking heads, and fear — all designed to make everyday people feel like investing is something other people do. People with suits, connections, or insider knowledge. The truth is much simpler. Exchange-traded funds — ETFs — were created so regular people could build wealth without needing to guess the next hot stock, time the market perfectly, or sit in front of screens all day. If you understand the basics and stay consistent, ETFs can quietly do the heavy lifting for you. This guide walks you through exactly how to invest in ETFs as a beginner, step by step. 1. What an ETF Actually Is (Plain English) An ETF (exchange-traded fund) is a collection of investments bundled together into one product that trades on the stock market. Instead of buying one company at a time, an ETF lets you buy small pieces of many companies at once. For example: When you buy an ETF, you’re not betting on one company — you’re betting on entire markets. That’s why ETFs are beginner-friendly: they reduce risk through diversification. 2. Why ETFs Are Ideal for Beginners ETFs solve many of the problems that stop people from investing in the first place. Low CostMost ETFs charge extremely low fees compared to traditional mutual funds. Over time, lower fees mean more money stays in your pocket. Instant DiversificationOne purchase can spread your money across dozens, hundreds, or even thousands of assets. Simple to UnderstandYou don’t need to analyze earnings reports or follow daily stock news. FlexibleETFs can be bought and sold just like stocks during market hours. For beginners, ETFs remove complexity without sacrificing growth. 3. Before You Invest: Set the Foundation Before buying any ETF, handle three basics first. Emergency CushionHave some cash set aside. Even $500–$1,000 helps prevent you from pulling investments out at the wrong time. High-Interest DebtCredit cards charging 20% interest will erase investment gains faster than the market can grow them. Clear GoalKnow why you’re investing. Retirement. Long-term wealth. Financial freedom. The goal determines how aggressive or conservative you should be. Investing works best when it supports your life — not when it creates stress. 4. Choose the Right Type of Account You don’t buy ETFs directly — you buy them through an account. The two main options: Taxable Brokerage AccountBest for flexibility. You can invest, withdraw, and add money anytime. You’ll pay taxes on gains. Retirement Accounts (IRA / Roth IRA / 401k)Designed for long-term wealth. Tax advantages make these powerful if you don’t need the money soon. If you’re unsure, many beginners start with a taxable brokerage and later add retirement accounts as income grows. 5. Understand Risk Without Fear Risk isn’t the enemy — misunderstanding it is. Stocks go up and down. That’s normal. ETFs smooth this volatility by spreading risk across many assets. As a beginner, your biggest risk is not investing at all. General rule: Time reduces risk. Panic increases it. 6. Beginner-Friendly ETF Categories You don’t need dozens of ETFs. Most beginners do well starting with just a few types. Total Market ETFsTrack the entire U.S. stock market. Broad, simple, effective. S&P 500 ETFsFocus on America’s largest companies. Historically strong long-term growth. International ETFsExpose you to markets outside the U.S. for global diversification. Bond ETFsProvide stability and income. Useful as your portfolio grows. Dividend ETFsFocus on companies that pay consistent dividends, offering income alongside growth. You don’t need everything — just balance. 7. How Much Money Do You Need to Start? There is no minimum “wealth level” to begin. Many ETFs allow: What matters is consistency, not size. A small amount invested regularly beats a large amount invested once and forgotten. 8. The Power of Dollar-Cost Averaging Dollar-cost averaging means investing the same amount on a schedule — regardless of market conditions. This approach: Markets reward patience, not prediction. 9. How to Place Your First ETF Trade The mechanics are simple. Once purchased, the real work is doing nothing. Overtrading hurts beginners more than market downturns. 10. How Often Should You Check Your Investments? Not often. Checking daily leads to emotional reactions. Long-term investing doesn’t require constant attention. A healthy rhythm: Wealth grows quietly — not through constant movement. 11. Common Beginner Mistakes to Avoid Chasing hypeIf everyone is talking about it, the opportunity is often already priced in. OvercomplicatingMore ETFs doesn’t mean better results. Selling during downturnsMarket drops are normal. Selling locks in losses. Ignoring feesSmall percentages compound over time — in either direction. Simplicity wins. 12. The Long View: Why ETFs Build Quiet Wealth ETFs don’t promise overnight riches. They promise something better: ownership, participation, and compounding over time. Many everyday investors built wealth not by brilliance, but by staying invested through recessions, booms, crashes, and recoveries. The market rewarded discipline, not drama. This is how wealth is built when no one is watching. Final Thought: Start Small, Stay Consistent You don’t need permission to invest.You don’t need perfect timing.You don’t need expert predictions. You need a plan, patience, and consistency. ETFs allow everyday people to participate in systems once reserved for institutions. Used correctly, they become quiet tools of freedom — growing in the background while you live your life. The best time to start was yesterday.The second best time is today. Focus Keyphrase how to invest in ETFs for beginners Slug how-to-invest-in-etfs-for-beginners Meta Description Learn how to invest in ETFs for beginners with this step-by-step guide from Black Dollar & Culture. Understand ETFs, reduce risk, and build long-term wealth with confidence.

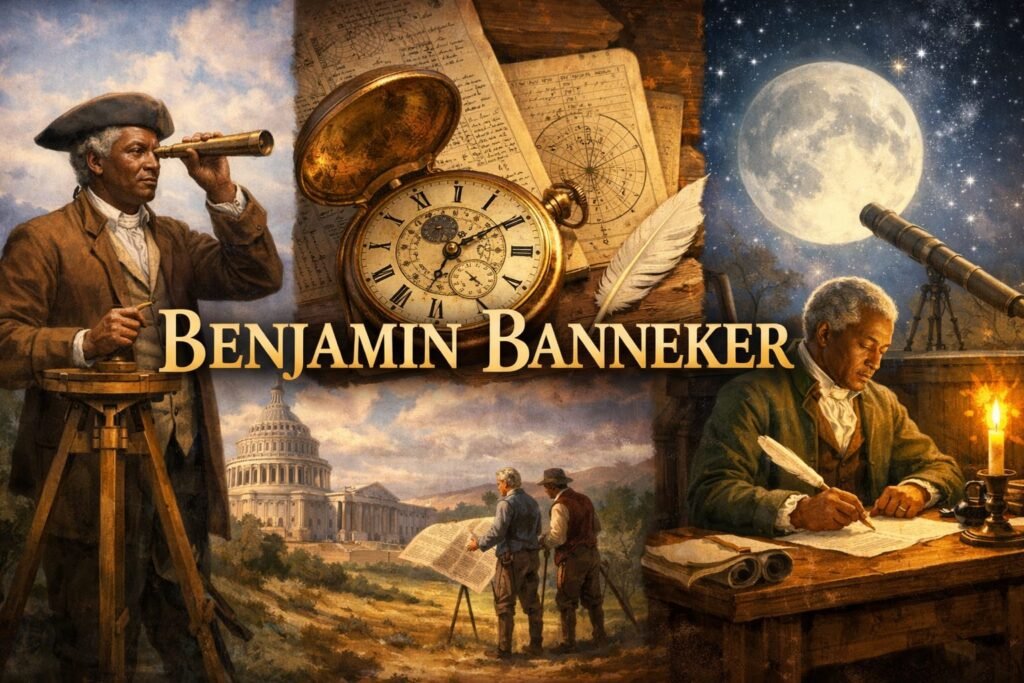

Benjamin Banneker: The Man Who Measured the Stars and Helped Build America

Benjamin Banneker was born in 1731 in rural Maryland, at a time when knowledge was tightly controlled and opportunity was rationed by class, race, and access. He was born free, yet freedom in colonial America did not include schools, institutions, or formal pathways into science or public life. What Banneker possessed instead was an uncommon discipline of mind, a relentless curiosity, and the ability to teach himself in a world designed to exclude him. From an early age, Banneker demonstrated a deep attentiveness to patterns. He observed the movement of shadows, the rhythm of seasons, the cycles of the moon, and the quiet logic underlying numbers. These observations were not passive. They became the foundation of a rigorous self-education in mathematics, astronomy, mechanics, and natural philosophy. Without classrooms or instructors, he relied on borrowed books, correspondence, and repeated experimentation. Knowledge, for Banneker, was not inherited or granted — it was earned through persistence. One of his earliest achievements revealed the breadth of his mechanical intelligence. After examining a pocket watch, Banneker constructed a fully functional wooden clock entirely by hand. At a time when precision timekeeping was rare and highly specialized, his clock reportedly kept accurate time for decades. This was not novelty craftsmanship. It was applied engineering — a synthesis of measurement, geometry, and mechanical reasoning executed with remarkable precision. Banneker’s attention soon turned upward to the night sky. Astronomy in the eighteenth century demanded advanced mathematical ability, extended observation, and exact calculations. Without formal training, Banneker mastered celestial mechanics well enough to calculate planetary positions, track lunar cycles, and accurately predict eclipses. These were not theoretical exercises. They became published data used by others. Between 1791 and 1796, Banneker authored and published a series of almanacs containing astronomical calculations, weather forecasts, tide tables, and practical information essential for farmers, navigators, and merchants. Almanacs were critical tools in early American life, shaping agricultural planning and commerce. Banneker’s editions were valued for their accuracy and circulated widely throughout the Mid-Atlantic region. His work entered daily life quietly, efficiently, and without spectacle. It was this reputation for precision that brought Banneker into one of the most consequential projects of the young nation: the surveying of the federal district that would become Washington, D.C. In 1791, he was appointed as an assistant to the survey team responsible for mapping the boundaries of the future capital. Using astronomical observations and mathematical calculations, Banneker helped establish the layout of the city. According to historical accounts, when the original design plans were lost following the departure of the chief planner, Banneker reproduced the layout from memory — an extraordinary demonstration of spatial reasoning and intellectual command. At the same time, Banneker understood that knowledge carried moral responsibility. In 1791, he wrote a carefully reasoned letter to Thomas Jefferson, then Secretary of State, addressing the contradiction between Jefferson’s stated belief in liberty and his participation in slavery. Banneker did not rely on rhetoric alone. He appealed to logic, evidence, and shared Enlightenment principles. Enclosed with the letter was a copy of his almanac — not as a plea for validation, but as proof of intellectual equality grounded in demonstrable work. Jefferson responded respectfully and forwarded Banneker’s almanac to intellectual circles in Europe. Yet the system itself remained intact. Still, the exchange endures as one of the most direct intellectual challenges to slavery issued during the early republic — a reminder that resistance did not always take the form of protest, but often appeared as clarity, data, and moral precision. Banneker lived the remainder of his life quietly. He never married, never accumulated wealth, and never sought public acclaim. In 1806, after his death, much of his work was lost in a fire that consumed his home. What survived did so unevenly — scattered across letters, publications, and partial historical records. Over time, his role in the nation’s formation was minimized, simplified, or omitted altogether. Yet Benjamin Banneker cannot be reduced to a symbol or an exception. He was a builder of systems, a producer of usable knowledge, and a contributor to the physical and intellectual infrastructure of the United States. His life stands as evidence that disciplined thought does not require permission, and that nation-building has always depended on minds history later chose not to emphasize. To study Benjamin Banneker is to confront a deeper truth about America’s origins: that progress was shaped not only by those whose names dominate monuments, but by thinkers whose work spoke for itself long before recognition followed. His legacy is not confined to clocks, almanacs, or survey lines. It is the enduring reminder that knowledge, once proven, cannot be erased — only delayed. Focus Keyphrase:Benjamin Banneker Washington DC Slug:benjamin-banneker-washington-dc Meta Description:Discover the true story of Benjamin Banneker, the self-taught polymath whose astronomical calculations and surveying work helped shape Washington, D.C., and challenged the contradictions of America’s founding ideals.

Why Your Paycheck Is the Least Important Part of Your Financial Life

Most people believe the key to financial security is earning more money. A bigger paycheck. A raise. A promotion. Another side hustle. And while income matters, this belief hides a dangerous truth: A paycheck is not wealth. It’s just a tool. If your entire financial plan depends on a paycheck continuing forever, you don’t have stability—you have exposure. And the system understands this far better than most people do. This is why some households earn six figures and still struggle, while others earn less but quietly build lasting wealth. Let’s break down what really matters. 1. A Paycheck Is Temporary by Design A paycheck depends on factors you don’t fully control: No matter how good the job is, a paycheck only exists as long as someone else allows it. Wealth, on the other hand, is designed to function without your daily presence. That’s the first major distinction most people are never taught. 2. Banks Don’t Respect Income — They Respect Structure Here’s something the system doesn’t advertise: Banks don’t analyze you emotionally.They analyze you structurally. They look at: A high income with no structure is treated as fragile.A modest income with assets, reserves, and discipline is treated as stable. This is why two people earning the same amount can be treated completely differently by financial institutions. 3. Income Is Fuel — Not the Destination Think of your paycheck like gasoline. Gas is necessary, but nobody confuses gas with the vehicle. Your paycheck should be used to: If all of your income is consumed by lifestyle, bills, and survival, then your paycheck is doing exactly what the system expects it to do: keep you running, but never arriving. 4. Ownership Outlives Effort Here’s the uncomfortable truth: You can work hard forever and still pass down nothing. Ownership is what survives: This is why wealthy families talk about control, not just cash. Cash gets spent. Control compounds. When income stops, ownership continues. 5. The Real Risk Is Dependency, Not Low Income Low income can be improved.High dependency is dangerous. If missing two paychecks would collapse your life, the issue isn’t how much you earn—it’s how exposed your financial structure is. True financial growth focuses on: Wealth isn’t loud. It’s resilient. 6. A Simple Shift That Changes Everything Instead of asking: “How can I make more money?” Start asking: “How can I make my money less necessary?” That question changes how you: This is where real financial freedom begins—not with hustle, but with intention. Final Thought Your paycheck is important—but it was never meant to be the foundation of your financial life. It’s a tool.A bridge.A starting point. The goal isn’t to earn forever.The goal is to build something that no longer requires permission. And once you understand that, you stop chasing money—and start designing stability. 📣 Keep the Conversation Going If this perspective shifted how you think about money, share this with someone who’s grinding but not building. Then explore more wealth-building strategies at Black Dollar & Culture, where we focus on ownership, structure, and legacy—because no one is coming to save us, and we don’t need them to. #BlackDollarCulture #FinancialLiteracy #WealthMindset #OwnershipEconomy #GenerationalWealth #FinancialFreedom #BuildTheBlock #QuietWealth #MoneyEducation #EconomicEmpowerment Focus Keyphrase: why paycheck is not wealthMeta Description: Most people chase bigger paychecks while ignoring ownership, structure, and control. Learn why income is the least important part of real wealth.Slug: why-your-paycheck-is-not-wealth

Money Rules the Rich Teach Their Kids (But Never Say Out Loud)

In certain households, money is never treated as a mystery. It’s not emotional, not dramatic, and not taboo. It’s discussed quietly, observed daily, and understood long before adulthood. Wealthy families rarely sit their children down and announce that they are about to teach them “the secrets of money.” Instead, they teach through behavior, structure, and repetition. By the time their children grow up, they don’t just earn money — they control it. One of the first unspoken lessons is that money is not the goal. In wealthy homes, money is framed as a tool. It exists to buy time, flexibility, and options. Children raised in these environments don’t chase money for validation. They learn that money is useful, but never emotional. This alone changes decision-making for life. When money loses its emotional charge, logic replaces impulse. Another quiet rule is that assets come before lifestyle. Wealthy parents do not rush to upgrade their lives every time income increases. Children grow up watching adults acquire businesses, equity, or income-producing assets before buying luxuries. The message isn’t spoken — it’s demonstrated. Lifestyle is something assets pay for, not something income is sacrificed to maintain. This creates patience and discipline that most people never develop. Jobs are also framed differently. In many households, a job is treated as the ultimate achievement. In wealthy families, a job is simply seed capital. Children hear conversations about using income to fund investments or ownership. Work is never positioned as identity. It’s positioned as leverage. As a result, wealthy children don’t grow up asking how to climb the ladder — they ask how to exit it. Ownership is the core principle behind everything. Cash is seen as temporary, while assets are permanent. Wealthy children grow up around deeds, shares, businesses, and partnerships. They understand early that ownership creates control, stability, and power. Saving money is respected, but hoarding cash is not glorified. Cash that isn’t deployed is seen as idle potential. Debt is another concept that’s handled with precision. In many families, debt is feared or misunderstood. In wealthy households, debt is treated like a tool that can either build or destroy depending on how it’s used. Children see debt used to acquire income-producing assets, never depreciating purchases meant for status. This distinction becomes second nature. Taxes are never framed emotionally either. Wealthy families don’t complain about taxes — they plan around them. Children overhear conversations about structure, strategy, and legal optimization. They learn early that taxes are not a punishment for success, but a penalty for ignorance. This understanding alone saves wealthy families millions over generations. One of the most powerful lessons is rarely spoken aloud: never sell an appreciating asset if you can borrow against it. Wealthy families hold onto assets and use loans for liquidity. This keeps ownership intact while allowing access to cash. Children raised with this mindset understand that selling stops compounding, while borrowing preserves it. Time is emphasized more than timing. Wealthy families teach patience by example. Children watch compounding happen slowly, then suddenly. They learn that starting early matters more than being perfect. Fast money loses its appeal when long-term growth proves unstoppable. Risk is not avoided — it’s managed. Wealthy parents don’t raise fearful children. They raise informed ones. Through diversification, insurance, and long-term planning, risk is reduced to something measurable rather than something terrifying. Children learn that avoiding risk entirely guarantees stagnation. Lifestyle inflation is quietly resisted. As income rises, expenses remain controlled. Children see adults live below their means while assets expand behind the scenes. This discipline protects future freedom and prevents wealth from leaking away unnoticed. Network is treated as an asset as well. Wealthy children grow up in environments where opportunity feels normal. Rooms matter. Conversations matter. Access changes outcomes faster than effort alone. This exposure shapes expectations for life. Perhaps the most important lesson is that wealth is taught at home. Schools are never relied upon to teach money. Children learn through participation, observation, and real-world involvement. Family discussions replace financial secrecy. Transparency replaces confusion. Finally, wealthy families value privacy. Quiet wealth is protected wealth. Flash is avoided. Attention is unnecessary. Power moves silently. Children learn that true wealth doesn’t need applause. By the time wealthy children become adults, the rules are already embedded. They don’t chase money. They deploy it. They don’t fear it. They control it. And that is the difference no one ever says out loud. Focus Keyphrase: money rules the rich teach their kids Meta Description: Explore the unspoken money rules wealthy families teach their children—covering assets, ownership, debt, taxes, discipline, and legacy thinking schools never explain. Slug: money-rules-the-rich-teach-their-kids

Black-Owned Businesses: Why Pouring Back Into the Community Is the Ultimate Power Move

This isn’t about charity. It’s about strategy.When Black-owned businesses reinvest into the communities that support them, they aren’t giving money away — they’re locking in longevity, loyalty, and leverage. History proves it. Modern data confirms it. And the future demands it. Before desegregation, before outside corporations flooded our neighborhoods, Black communities circulated the dollar dozens of times before it ever left. That circulation built schools, banks, hospitals, newspapers, and generational wealth. The collapse didn’t happen because the model failed — it happened because the system was disrupted. Here’s why pouring back in is not optional, but essential. 1. Community Investment Multiplies Business Survival Money spent locally doesn’t disappear — it cycles.When a Black business hires locally, sources locally, or sponsors locally, the community becomes economically invested in that business’s survival. That’s how you create customers who don’t just buy once — they defend your brand. • Local Jobs create Stable customers• Local Vendors reduce Costs and dependencies• Local Loyalty increases Lifetime value A supported community protects its own. 2. Wealth Circulation Builds Economic Immunity Every dollar that leaves the community weakens it.Every dollar that stays strengthens it. When Black businesses reinvest — through scholarships, youth programs, apprenticeships, or community real estate — they reduce dependency on outside systems that were never designed to protect us. This isn’t emotional. It’s mathematical. 3. Reinvestment Creates the Next Generation of Owners Communities don’t rise by consumption alone — they rise by ownership transfer. When successful Black businesses mentor youth, fund internships, or teach financial literacy, they aren’t just helping — they’re creating future partners, suppliers, and successors. Ownership is taught. Power is modeled. 4. Trust Is the New Currency In a world of ads, algorithms, and distractions, trust beats marketing. A business that visibly pours back into the community earns:• Word-of-mouth growth• Free brand ambassadors• Crisis-proof support People support what supports them. 5. Economic Power Is Political Power (Without Politics) You don’t need permission when you control resources. Communities with strong local businesses:• Fund their own initiatives• Solve problems internally• Negotiate from strength Reinvestment turns neighborhoods into economic blocs, not begging grounds. 6. The Blueprint Already Exists We don’t need new ideas — we need discipline and execution. From Greenwood (Black Wall Street) to Durham’s Black banking class, history shows that community-centered business models work when we commit to them long-term. The goal isn’t to escape the community — it’s to elevate it with you. The Bottom Line Black-owned businesses that pour back into the community don’t shrink — they compound. This is how legacies are built.This is how ecosystems form.This is how wealth stops leaking and starts circulating. 👉 Read more stories like this — and learn how ownership really works. ❤️ Support Independent Black Media Black Dollar & Culture is 100% reader-powered — no corporate sponsors, just truth, history, and the pursuit of generational wealth. Every article you read helps keep these stories alive — stories they tried to erase and lessons they never wanted us to learn. #BlackOwnedBusiness #BlackWealth #EconomicPower #CommunityEconomics #BuyBlack #GenerationalWealth #BlackDollar #OwnershipMindset #BlackEntrepreneurs Focus Keyphrase: Black owned businesses community reinvestmentSlug: black-owned-businesses-community-reinvestmentMeta Description: Why Black-owned businesses pouring back into the community isn’t charity — it’s a proven strategy for wealth circulation, loyalty, and generational power.

Why Gold Protects Wealth When Markets Collapse

Markets don’t collapse overnight—they unravel quietly, then all at once. Long before the headlines turn red and panic becomes fashionable, confidence begins to erode beneath the surface. Liquidity tightens, assumptions fail, and investors realize—too late—that optimism was doing more work than fundamentals. When that confidence breaks, gold does what it has always done: it holds. Gold has never been an asset of excitement. It doesn’t trend on social media, it doesn’t promise outsized returns, and it doesn’t rely on narratives. It exists for moments of stress—when systems are questioned, currencies are diluted, and trust in leadership weakens. After surviving multiple market cycles, one lesson becomes unavoidable: markets reward growth, but wealth survives through protection. When stock markets collapse, it’s rarely because companies disappear overnight. It’s because valuations were built on fragile assumptions—cheap money, endless growth, stable geopolitics. Once those assumptions crack, repricing is swift and unforgiving. Gold doesn’t reprice on earnings calls or guidance forecasts. It responds to fear, uncertainty, and instability—the very conditions that define market collapses. Cash feels safe during chaos, but history exposes its weakness. Inflation quietly erodes purchasing power while governments respond to crises with stimulus, debt expansion, and money creation. Every collapse is met with liquidity, and liquidity always comes at a cost. Gold has no printing press. Its scarcity is real, which is why it preserves value when paper assets struggle to do the same. This is precisely why central banks hold gold. Not for tradition—but for credibility. When trust between nations weakens, gold becomes neutral ground. When debt loads grow uncomfortable, gold becomes reassurance. When currencies wobble, gold becomes stability. The same logic applies at the individual level. Another overlooked advantage of gold during market collapses is optionality. The most dangerous position an investor can be in during a downturn is forced selling. Gold provides liquidity without forcing the liquidation of productive assets at the worst possible moment. It buys time, and time is often the difference between recovery and permanent loss. Gold also behaves differently than most assets during crises. While correlations across markets tend to spike during panic, gold often diverges. It may not surge immediately, but it holds ground while others fall. That stability matters far more than aggressive upside when the goal is wealth preservation. The wealthy understand this distinction clearly. They don’t buy gold to outperform equities in bull markets. They hold it to survive bear markets. Gold is not designed to make headlines—it’s designed to protect capital when headlines turn ugly. History reinforces this lesson repeatedly. Empires rise and fall. Currencies are introduced, abused, and replaced. Financial systems evolve, break, and rebuild. Through every version of that cycle, gold remains relevant—not because it is old, but because it is independent. Gold does not replace businesses, real estate, or equities. It complements them. Think of it as structural support rather than decoration. You don’t admire it when times are calm, but without it, the foundation cracks under pressure. When markets collapse, emotions spread faster than facts. Gold does not react to emotion. It doesn’t panic, doesn’t promise, and doesn’t explain itself. It simply holds value while everything else explains why it can’t. That is why gold protects wealth—not through excitement, but through endurance. ❤️ Support Independent Black Media Black Dollar & Culture is 100% reader-powered — no corporate sponsors, just truth, history, and the pursuit of generational wealth. Every article you read helps keep these stories alive — stories they tried to erase and lessons they never wanted us to learn. Focus Keyphrase:gold protects wealth Slug:why-gold-protects-wealth-when-markets-collapse Meta Description:When markets collapse and confidence disappears, gold has historically protected wealth. Learn why gold remains a powerful hedge during economic uncertainty.

Bessie Coleman: The Woman Who Refused to Stay Grounded

Bessie Coleman was born on January 26, 1892, in Atlanta, Texas, at the intersection of poverty, racism, and rigid limitation. She was the tenth of thirteen children born to George and Susan Coleman, a family of sharecroppers whose lives were shaped by the unforgiving realities of post-Reconstruction America. Cotton fields, long days, and scarce opportunity defined her early years. Education existed, but barely—one-room schoolhouses, worn textbooks, and interrupted learning whenever farm labor demanded it. Yet even in those conditions, Bessie showed an early hunger for knowledge, discipline, and something beyond the horizon. Her father eventually left the family, returning to Indian Territory in Oklahoma in search of a better life, while Bessie remained with her mother, helping raise her siblings and working the fields. Poverty was not an abstract concept to her; it was lived daily. But so was resilience. She excelled in school when she could attend, eventually saving enough money to enroll at Langston University in Oklahoma. Her time there was short—financial hardship forced her to withdraw—but the seed of ambition had already taken root. She would not accept a life dictated by circumstance. In her early twenties, Bessie moved to Chicago, joining the Great Migration of Black Americans seeking opportunity beyond the South. There, she worked as a manicurist, a job that placed her in close proximity to conversation, news, and stories from beyond her world. It was in a barbershop that her life took its decisive turn. She listened as Black men returned from World War I spoke of flying in Europe. They talked about airplanes, freedom, and skies that did not feel segregated. Her brothers, particularly one who had served in France, taunted her—telling her that French women could fly planes while American Black women could not. Instead of discouraging her, the insult ignited something irreversible. Bessie Coleman decided she would fly. The problem was America had no intention of letting her do so. Every aviation school she applied to rejected her. The rejections were absolute—no appeals, no alternatives. She was dismissed not for lack of intelligence or ability, but because she was both Black and a woman. In the early 20th century, flight was considered the domain of white men only. Rather than accept the denial, Bessie made a decision that defined her legacy: if America would not teach her, she would leave America. She enrolled in French language classes, saved her earnings meticulously, and gained sponsorship from influential Black newspapers, including the Chicago Defender. In 1920, she sailed to France. This alone was radical—an unmarried Black woman traveling abroad for professional training at a time when many Americans never left their home counties. In France, she trained at the Caudron Brothers’ School of Aviation, one of the most respected flight schools in the world. Flying in the 1920s was not glamorous. Planes were unstable, cockpits open to the elements, and crashes common. Training involved risk at every step. Bessie endured crashes, injuries, and intense discipline. But she persisted. On June 15, 1921, she earned her international pilot’s license from the Fédération Aéronautique Internationale, becoming the first Black woman in the world to do so—and one of the first Americans of any race to hold that distinction. When Bessie returned to the United States, her achievement should have made her a national hero. Instead, she encountered the same walls she had left behind. Airlines would not hire her. Commercial aviation opportunities were closed. Once again, racism tried to ground her ambitions. This time, she refused to stop moving forward. Bessie turned to barnstorming—performing aerial stunts at airshows across the country. Loop-the-loops, dives, figure-eights—she mastered them all. But her performances were not about spectacle alone. They were statements. Every time she climbed into a cockpit, she challenged the idea that Black people belonged only on the ground. She attracted massive crowds, especially in Black communities, where many had never seen an airplane up close, let alone one piloted by a Black woman. She was also uncompromising in her principles. Bessie refused to perform at venues that enforced segregated seating. If Black spectators were forced to enter through back gates or sit separately, she would not fly. This stance cost her income and opportunities, but she would not trade dignity for exposure. To her, flight symbolized freedom, and freedom could not exist alongside humiliation. Her vision extended far beyond stunt flying. Bessie dreamed of opening a flight school for Black aviators—men and women—so future generations would not have to leave the country to learn what she had fought to access. She spoke publicly about this goal, emphasizing education, discipline, and ownership of the skies. She wanted Black pilots, Black mechanics, Black instructors—an aviation ecosystem independent of exclusionary systems. Tragically, that dream was cut short. On April 30, 1926, in Jacksonville, Florida, Bessie Coleman boarded a plane for a practice flight ahead of an upcoming airshow. The aircraft was piloted by her mechanic, William Wills. Bessie was not wearing a seatbelt because she was scouting the terrain below, preparing for a parachute jump she planned to perform later. Mid-flight, the plane experienced a mechanical failure—later determined to be caused by a loose wrench lodged in the engine. The aircraft went into a sudden nosedive. Bessie was thrown from the plane at 2,000 feet and died instantly. She was 34 years old. Moments later, the plane crashed, killing Wills as well. Her death sent shockwaves through Black communities across the country. Thousands attended her funeral in Chicago. Leaders, activists, and ordinary people mourned not just the loss of a woman, but the loss of a future she represented. She died without ever opening the flight school she envisioned, without seeing the aviation doors she cracked open fully swing wide. Yet her impact did not end with her life. Bessie Coleman became a symbol—of courage without permission, of ambition without apology. Her legacy inspired future generations of Black aviators, including the Tuskegee Airmen during World War II. Pilots flew in her honor. Schools, clubs, and scholarships were named