The Cheapest Way to Start Investing With Just $5 (Yes, Really)

Most people believe investing is something you do after you make money.That belief alone has kept millions of people permanently on the sidelines. The truth is uncomfortable for the system—but powerful for you: Investing doesn’t start with wealth.Wealth starts with investing. And today, that journey can begin with just $5. ❤️ Support Independent Black Media Black Dollar & Culture is 100% reader-powered — no corporate sponsors, just truth, history, and the pursuit of generational wealth. Every article you read helps keep these stories alive — stories they tried to erase and lessons they never wanted us to learn. 1. The Lie That Investing Is “Only for People With Money” For decades, investing was intentionally framed as something exclusive. You needed: This wasn’t accidental. When people believe investing is unreachable, they: The result?Generations trapped in a cycle where money passes through them, not works for them. But the rules quietly changed. Technology removed the gatekeepers—yet the old mindset remained. 2. What $5 Can Actually Buy You Today Thanks to fractional investing, you no longer need to buy an entire share of a company. You can buy a piece. That $5 can now purchase: This matters because ownership compounds, even in small amounts. While $5 in a savings account stays $5 (or loses value to inflation),$5 invested participates in growth. You’re no longer just holding money.You’re deploying it. 3. Why ETFs Are the Smartest Place to Start With $5 For beginners, the goal is not excitement.The goal is survival and consistency. That’s why Exchange-Traded Funds (ETFs) are ideal. ETFs: Instead of betting on one company, you’re betting on the system itself continuing to grow. This is not gambling.This is ownership. 4. The Real Power Isn’t the $5 — It’s the Habit Here’s what most people miss: The dollar amount matters far less than the behavior. When you invest $5: Small, repeated actions beat large, emotional decisions every time. Someone who invests $5 consistently will outperform someone who waits years for “the right time.” Because the market rewards time, not perfection. 5. A Simple $5 Investing Strategy That Actually Works This isn’t complicated. That’s the point. Step 1: Choose one broad-market ETFStep 2: Invest $5 weekly or bi-weeklyStep 3: Automate itStep 4: Ignore the noise No charts.No predictions.No panic. Over time, your money benefits from: You’re no longer guessing.You’re participating. 6. What NOT to Do With $5 Starting small doesn’t mean acting reckless. Avoid: Those strategies punish beginners and reward experience. $5 is not for chasing dopamine.It’s for building discipline and foundation. Wealth grows quietly before it grows loudly. 7. Why Waiting Is More Expensive Than Starting Small People often say:“I’ll invest when I make more.” But every year you wait: Time is the most expensive currency you own. Starting with $5 today beats starting with $500 five years from now. Because ownership rewards patience, not pride. 8. How This Connects to Generational Wealth Generational wealth doesn’t begin with inheritance.It begins with knowledge and repetition. When investing becomes normal: The amount grows later.The mindset must start now. This is how families quietly separate from the financial struggle most people accept as normal. 9. The Psychological Shift That Changes Everything Once you invest—even with $5—you cross a line. You stop asking:“How much does this cost?” And start asking:“What does this return?” That shift changes how you see: Ownership rewires thinking. And thinking shapes outcomes. 10. Final Truth Most People Never Hear You don’t start investing because you’re rich.You get rich because you start investing. The cheapest way to begin isn’t about money. It’s about deciding to own. Frequently Asked Questions Is investing $5 really worth it?Yes—because it builds habit, exposure, and discipline. The habit matters more than the amount. Is it better to save or invest $5?Emergency savings come first, but long-term growth requires investing. Saving alone does not build wealth. How often should I invest small amounts?Weekly or bi-weekly works best. Consistency beats timing. Can small investments really grow over time?Yes. Compound growth rewards time in the market, not size of the first deposit. Slug: cheapest-way-to-start-investing-with-5-dollarsMeta Description: Learn the cheapest way to start investing with just $5. Discover how small, consistent investing builds real wealth, ownership, and long-term financial freedom—even for beginners.

Madam C.J. Walker: The First Self-Made Black Woman Millionaire America Tried to Forget

Before Silicon Valley. Before hedge funds. Before Wall Street started pretending it understood “self-made.”There was Madam C. J. Walker—a Black woman born into the ashes of slavery who built an empire so powerful it terrified the systems designed to keep her small. She was not handed opportunity.She was not invited into rooms.She was not protected by laws, banks, or sympathy. She built anyway. Born in 1867, just two years after the end of slavery, Sarah Breedlove entered a country that had legally ended bondage but economically perfected it. Her parents had been enslaved. Her childhood was marked by loss. Orphaned by seven, married by fourteen, widowed by twenty, and raising a daughter alone, she lived the kind of life America usually erases—not because it’s rare, but because it exposes the lie. The lie that success is granted fairly.The lie that hard work is enough—unless you own the system. Sarah worked as a washerwoman, scrubbing clothes for pennies while breathing in steam and chemicals that damaged her scalp so badly her hair began to fall out. But what others saw as humiliation, she treated like research. She listened. She observed. She experimented. And then she made a decision that would echo across generations: She stopped asking for permission. She studied hair care the same way financiers study markets. She learned chemistry, formulation, branding, and sales—without a degree, without capital, without protection. When she created her first successful hair product, she didn’t sell it quietly. She sold it boldly, face-to-face, door-to-door, Black woman to Black woman. She renamed herself Madam C.J. Walker—not to impress white America, but to signal authority to her own people. In an era where Black women were called “girl” well into old age, she crowned herself Madam and dared anyone to object. They didn’t know what to do with her. Walker didn’t just sell products—she built infrastructure. She opened factories. She purchased real estate. She trained thousands of Black women as sales agents, not as servants but as entrepreneurs, teaching them financial literacy, confidence, and independence in a society that wanted them invisible. Her agents—called “Walker Agents”—earned commissions, owned businesses, traveled the country, and sent their children to school. At a time when Black labor was exploited and controlled, she created ownership. And that was the real threat. By the early 1900s, Walker had built a national brand. She employed thousands. She reinvested heavily into Black institutions—schools, churches, newspapers, and civil rights causes. She donated to anti-lynching campaigns when silence was safer. She funded Black education when the state refused to. She understood something America still struggles to admit: Wealth is not about money.It’s about leverage. When she built her mansion, Villa Lewaro, in New York, it wasn’t indulgence—it was strategy. A visible declaration that Black excellence could not be hidden, that success did not need white approval to be legitimate. The backlash was predictable. White media minimized her. Historians downplayed her. The phrase “self-made” was twisted to exclude her, even though she built from literal nothing. For decades, her story was softened, diluted, reduced to “hair care” instead of what it truly was: A masterclass in Black capitalism. Madam C.J. Walker didn’t just get rich—she redistributed power. She created a blueprint modern America still refuses to teach: • Control production• Own distribution• Train your people• Reinvest into the community• Use wealth as a weapon against injustice When she died in 1919, she was one of the wealthiest women in the country—Black or white. But more importantly, she left behind a network of educated, financially independent Black women who knew their value and refused to shrink. That was her real inheritance. Today, her name is finally resurfacing, often stripped of its sharpest edges, packaged as inspiration without instruction. But Madam Walker was not a motivational quote. She was a warning. A warning of what happens when Black people are left alone long enough to build. Her life answers a question America still avoids: What would this country look like if Black builders had never been sabotaged? The answer is uncomfortable.So they buried the evidence. But history has a habit of resurfacing when the moment demands it. And right now—when ownership is once again the dividing line between survival and struggle—Madam C.J. Walker’s story isn’t just history. It’s instruction. ❤️ Support Independent Black Media Black Dollar & Culture is 100% reader-powered — no corporate sponsors, just truth, history, and the pursuit of generational wealth. Every article you read helps keep these stories alive — stories they tried to erase and lessons they never wanted us to learn. Slug:madam-cj-walker-first-self-made-black-woman-millionaire Meta Description:Madam C.J. Walker was the first self-made Black woman millionaire, building a business empire from nothing while empowering thousands of Black women and reshaping American economic history.

Don’t Get Caught Up in Sports Betting — It’s Being Aggressively Targeted at Black Communities

Sports betting isn’t just a trend.It’s a system. And like most systems that suddenly receive unlimited advertising dollars, celebrity endorsements, and algorithmic placement, it isn’t neutral — it’s strategic. Over the past few years, sports betting has been pushed into American culture at record speed. Apps are everywhere. Ads are nonstop. Promotions promise “free money.” And the messaging is clear: this is entertainment, this is easy, this is normal. But if you zoom out, a disturbing pattern appears. Black communities are being disproportionately targeted — and the consequences are quietly devastating. 1. This Isn’t Accidental — It’s a Business Model Sports betting companies don’t guess where to advertise. They analyze data. They know: Black audiences sit at the intersection of all four. That’s why betting ads flood: This isn’t about fun. It’s about volume and repeat behavior. 2. Why Sports Betting Hits Harder Than the Lottery The lottery is slow.Sports betting is constant. With betting apps, there is: You can bet: This turns betting into a habit loop — not an event. And habit loops drain money quietly. 3. The “Skill Game” Lie One of the most dangerous narratives around sports betting is the idea that it’s based on knowledge or intelligence. “You know the sport.”“You watch the games.”“You understand the players.” But betting markets are not built for fans to win long-term. They are built using: The house doesn’t beat you because you’re dumb.It beats you because it’s designed to. 4. Why This Matters for Black Wealth Every dollar lost to betting is a dollar: Sports betting doesn’t just take money — it steals time, focus, and discipline. And unlike investing, ownership, or entrepreneurship, betting creates no asset. There is nothing left behind. No equity. No growth. No compounding. Just a dopamine spike followed by loss. 5. The Psychological Trap Nobody Talks About Sports betting preys on three powerful emotions: Hope keeps you playing.Pride convinces you that you’re “one good bet away.”Recovery makes you chase losses. This cycle mirrors the same emotional traps used in: The difference is that sports betting is packaged as culture. 6. Athletes, Celebrities, and the Illusion of Access When athletes and celebrities promote betting apps, it creates the illusion that: But endorsements aren’t participation — they’re payment. The people promoting betting aren’t funding their lives with bets. They’re funding them with contracts. That distinction matters. 7. What Real Strategy Looks Like Real wealth strategy is boring.It’s slow.It’s disciplined. It looks like: There is no generational wealth blueprint that includes “consistent sports betting” as a pillar. None. Final Thought Sports betting isn’t empowering Black communities — it’s extracting from them. It converts passion into loss, attention into profit for corporations, and hope into dependency. And it does all of this while pretending to be entertainment. The real win isn’t hitting a parlay. The real win is recognizing the trap — and choosing ownership instead. ❤️ Support Independent Black Media Black Dollar & Culture is 100% reader-powered — no corporate sponsors, just truth, history, and the pursuit of generational wealth. Every article you read helps keep these conversations alive — conversations designed to protect, inform, and empower our people. Focus Keyphrase: sports betting targeting Black communitiesSlug: sports-betting-targeting-black-communitiesMeta Description: Sports betting is aggressively targeting Black communities. This article breaks down why it’s dangerous, how the system works, and why it undermines long-term wealth.

Queen Amanirenas: The Warrior Queen of Kush and Her Enduring Legacy

The Rise of Amanirenas: A Historical Overview Queen Amanirenas emerged as a significant figure in ancient history, hailing from the Kingdom of Kush, located to the south of Egypt. Her origins can be traced back to a time when the Kingdom was a powerful and prosperous entity, known for its rich resources and strategic location. Amanirenas likely belonged to the royal lineage, which granted her the privilege and responsibility of leadership during an era when female rulers were a rarity in a predominantly patriarchal society. The ascent of Amanirenas to power occurred during a tumultuous period marked by conflict and territorial disputes with Egypt. Following the invasion of Kush by Augustus Caesar, Amanirenas took control of her kingdom and positioned herself as a formidable leader. Her determination was fueled by the desire to protect her homeland from foreign aggression and to establish her reign based on strength and resilience. This was a significant departure from the traditional view of women in her time, who were often limited to domestic roles. Amanirenas’s leadership was characterized by her military prowess as well as her ability to negotiate alliances. Historical records indicate that she marred her strategic capabilities with diplomatic initiatives, which ultimately helped to unite various factions within her realm. The conflicts against the Romans, particularly during her reign in the 1st century BC, served not only to solidify her reputation as a warrior queen but also significantly impacted the socio-political landscape of the region. These key events set the stage for her legendary status and illuminated her role both as a military commander and as a political strategist within the wider context of Kushite society. The War Against Rome: Amanirenas as a Warrior Queen Queen Amanirenas, the esteemed ruler of the Kingdom of Kush, is primarily remembered for her fierce and successful military campaigns against the expansive forces of the Roman Empire during the reign of Emperor Augustus. In a series of confrontations that unfolded around 30 BCE, Amanirenas demonstrated her extensive leadership capabilities, employing strategic military tactics that would ensure her kingdom’s independence from Roman dominion. The conflict began as Rome sought to expand its territories, threatening the sovereignty of neighboring kingdoms, including Kush. Amanirenas, understanding the significance of her position, rallied her troops and initiated bold military campaigns. Her forces, notable for their resilience and commitment, utilized guerrilla warfare tactics, ambushing Roman legions and executing surprise attacks that often led to significant victories. These tactics were instrumental in overcoming the challenges posed by a more technologically advanced army. One of the most notable engagements occurred during the Roman invasion, where Amanirenas’s army, significantly outnumbered, displayed exemplary valor. The battle tactics of her forces included the use of the terrain to their advantage, as well as guerrilla tactics that allowed them to inflict considerable damage on the Roman troops. As a result of these engagements, Kush maintained its autonomy, and Amanirenas emerged as a symbol of resistance against imperial expansion. Apart from military prowess, Amanirenas’s leadership became emblematic of strength and bravery and served as a significant motivator for her people. Her success in repelling the Roman forces fostered a sense of unity among the Kushites, reinforcing their cultural identity in the face of external threats. The enduring legacy of her reign and military campaigns continues to resonate, showcasing her as a paramount figure in the annals of history, particularly in the context of resistance against imperial dominance. Cultural and Religious Contributions of Queen Amanirenas Queen Amanirenas, a pivotal figure in the history of Kush, made remarkable contributions to the cultural and religious spheres, leaving an indelible mark on Nubian heritage. Her reign was characterized by an emphasis on the arts, with notable patronage of various artistic endeavors that enriched the cultural tapestry of her kingdom. One of her significant contributions was the commissioning of grand architectural projects, including temples dedicated to both traditional Kushite deities and newly embraced practices. These structures served not only as places of worship but also as symbols of her power and commitment to the spiritual well-being of her people. Amanirenas was integral to the revitalization of local belief systems, fostering a syncretism that allowed various religious traditions to coexist. Her encouragement of the arts extended beyond architecture to include sculpture, pottery, and jewelry, which flourished during her reign. Artistic expressions of this period reflected both the strength of a warrior queen and the profound spirituality of the Kushite people. Statues and reliefs often depicted her in a formidable manner, reinforcing her status not only as a ruler but also as a divine figure, encapsulating the interrelation between leadership and religion. The economic prosperity of Kush during her reign facilitated these cultural advancements, as resources were allocated to support artists and religious practices. Moreover, Amanirenas’s cultural policies helped promote a sense of unity among her subjects, strengthening their identity and pride in their Nubian roots. Her legacy is evident in the continued reverence for these artistic and religious traditions by subsequent generations, showcasing her role as a catalyst for cultural evolution in Kush. The enduring influence of Queen Amanirenas is thus reflected in the vibrancy of Nubian culture that thrived both during and long after her reign. A Legacy Remembered: The Lasting Impact of Amanirenas Queen Amanirenas, the formidable warrior queen of the Kingdom of Kush, has left an indelible mark on both historical narratives and contemporary culture. Her reign during a time of conflict with Rome showcases her tenacity and strategic prowess, positioning her as a symbol of resistance against imperial domination. This imagery has resonated through the ages, with Amanirenas emerging as an iconic figure exemplifying the strength of female leadership. The story of Amanirenas is remembered not only in historical texts but also celebrated in modern interpretations. Scholars have revisited her life, bringing to light her contributions and the socio-political dynamics of her era. Recent academic discussions emphasize her role in the increasingly relevant dialogue surrounding the empowerment of women in history, illustrating how her legacy transcends time and geography. Through

The Significance of December 19, 1865: A Pivotal Moment in Black History

Understanding the 13th Amendment The 13th Amendment, ratified on December 6, 1865, represents a critical juncture in American history, particularly in the advancement of civil rights for African Americans. It abolished slavery and involuntary servitude, except as punishment for a crime, thereby laying the groundwork for future legislative and social reforms aimed at achieving equality. The Amendment’s roots can be traced back to the broader context of the Civil War, where the fight against the Confederacy was also a fight against the institution of slavery itself. The passage of the 13th Amendment was championed by numerous abolitionists, politicians, and leaders of the Union. Key figures such as President Abraham Lincoln played a pivotal role, utilizing his influence to promote emancipation as a war measure. During the war, the moral imperative to end slavery gained traction, causing a significant shift in public opinion. This advocacy was set against a backdrop of intense political strife, as various factions within Congress debated the future of the Union and the fate of millions of enslaved individuals. The political climate of the time was marked by a struggle for power between pro-slavery and anti-slavery factions. The Republican Party, having emerged from the abolitionist movement, found its platform centered around the idea of freedom for all individuals. The Civil War solidified the urgency for the passage of the 13th Amendment, as the Union victory prompted discussions about the reconstruction of the nation and the status of freed slaves. Ultimately, the amendment’s ratification marked a significant change in the constitutional fabric of the United States, signaling a new era in which African Americans could begin to claim their rights as free citizens. The Implications of Freedom without Economic Power The abolition of slavery in 1865 marked a significant milestone in American history, ushering in a new era of freedom for African Americans. However, this newfound freedom often came with the harsh reality of economic disenfranchisement. While individuals were freed from the shackles of bondage, they were not provided with the resources or opportunities necessary to thrive in a competitive economy. The transition from slavery to freedom did not automatically translate into equality, particularly in terms of economic power. Many newly freed African Americans found themselves without land, capital, or education, which severely limited their ability to achieve financial independence. The promise of land grants and economic support was largely unmet, leaving them to navigate a landscape marred by systemic barriers. The practice of sharecropping emerged as a dubious solution, perpetuating a cycle of debt and poverty. In this system, African Americans would rent land from white landowners in exchange for a share of the crop, often leading to exploitation and barely subsistence living. Moreover, labor exploitation was rampant, as many freed individuals were relegated to low-paying jobs that offered no room for advancement. Economic opportunities were scarce, as racial discrimination restricted access to skilled employment and education. Such circumstances perpetuated economic disparities that would haunt Black communities for generations. Without access to economic resources, the struggle for true freedom continued, affecting the social fabric and future prospects of African Americans. This intersection of freedom with economic power underscores an essential understanding of Black history, highlighting the ongoing challenges faced by these communities in their pursuit of equality. Legacy of the 13th Amendment in Modern America The passage of the 13th Amendment on December 6, 1865, marked a significant turning point in American history by signaling the formal abolition of slavery. However, the legacy of this pivotal amendment extends far beyond its initial intent, as it continues to influence discussions on racial inequality and social justice in contemporary society. While the formal institution of slavery ended, various systemic issues, such as mass incarceration and economic disparities, have arisen that disproportionately affect African Americans. Mass incarceration has emerged as a leading concern in discussions surrounding the 13th Amendment. Many advocates argue that although the amendment abolished slavery, it inadvertently allowed for a new form of servitude through prison labor. The current penal system, with its disproportionate representation of Black individuals, raises critical questions about the true nature of freedom. Activists cite the over-policing of African American communities and harsh sentencing laws as modern manifestations of racial discrimination that demand attention and reform. In addition to incarceration, economic empowerment remains a significant challenge for African Americans. Despite legal advancements since the 13th Amendment, there are ongoing disparities in wealth and employment opportunities. Efforts to address these disparities, such as advocating for fair hiring practices and equitable access to education, are essential steps towards achieving true equality. Grassroots movements led by organizations focused on civil rights, such as Black Lives Matter, have emerged in response to these challenges, further emphasizing the need for systemic change. In examining the enduring legacy of the 13th Amendment, it is clear that the fight for freedom and equality for African Americans is far from complete. Historical and contemporary issues intersect to create a complex landscape that requires continued advocacy and policy reform to ensure that the promise of the 13th Amendment is fully realized. Only through persistent efforts can the ideals of freedom and equality be truly achieved for all citizens. Commemoration and Reflection on December 19 December 19, 1865, marks a significant turning point in Black history, representing a time when African Americans began to gain momentum in their fight for freedom and equality. This date is not only a historical milestone but also serves as a reminder of the ongoing struggles faced by Black communities. In the years since, various educational initiatives have been instituted to ensure that this pivotal moment is recognized and remembered. Schools, colleges, and community organizations often host events on this day to foster awareness and understanding of its importance. Black leaders and movements play a crucial role in advocating for economic justice, promoting the significance of this date as a cornerstone of freedom. These leaders often remind us that the fight for equality extends beyond the abolition of slavery, encompassing various facets of social justice, including access

What Happens to the Black Community When Black Men Marry Outside the Race?

For decades, conversations around Black men dating or marrying outside the race have been framed emotionally — accusations, defensiveness, and surface-level debates about “preference.” But very little attention is paid to the structural impact of these choices on the Black community as a whole. This article isn’t about policing love.It’s about understanding how marriage functions as an economic and social institution — and what happens when participation in that institution becomes uneven. According to Pew Research Center, about 24% of Black male newlyweds married outside their race, compared to roughly 9% of Black female newlyweds. That imbalance alone creates long-term consequences that go far beyond individual relationships. Let’s break down what that actually means. Marriage in America is the primary mechanism through which wealth is pooled, protected, and passed down. Two incomes combine, assets are acquired jointly, homes are purchased, businesses are built, and children inherit both financial and social capital. When a Black man marries within the Black community, those economic benefits are statistically more likely to circulate within Black households, Black neighborhoods, and Black institutions. When a significant portion of Black men marry outside the race, a growing share of Black male income, assets, and future earnings becomes structurally anchored outside the Black community. This isn’t about intentions. It’s about where capital compounds over time. The effect multiplies across generations. Children are the carriers of legacy — not just DNA, but culture, identity, and economic direction. Research consistently shows that children spend more time in the primary custodial household, usually the mother’s. Cultural identity, social networks, and future relationship patterns tend to follow that environment. Over time, this leads to fewer Black-identified households, fewer Black family units, and weaker continuity in culture, economics, and community affiliation. The imbalance also directly affects Black women. Because Black men marry outside the race at nearly three times the rate of Black women, the available marriage pool shrinks. This contributes to lower marriage rates among Black women, delayed family formation, and a higher prevalence of single-parent households. That matters because two-parent households, regardless of race, statistically accumulate more wealth, experience less economic stress, and provide more stability for children. This isn’t a moral judgment — it’s a demographic reality. There’s also a political and economic dimension that often goes unspoken. Marriage influences where people live, which schools children attend, where families invest, how they vote, and which businesses they support. When high-earning Black men — especially athletes, entertainers, and executives — marry outside the race, their economic footprint, political influence, and philanthropy frequently become integrated into other communities rather than anchored in Black ones. That’s why the impact feels larger than the numbers suggest. While celebrities make up a small percentage of Black men, they represent an outsized share of visible Black wealth. When those resources exit the community, the loss is amplified — not symbolically, but materially. Still, it’s important to be precise: interracial marriage itself is not the problem. The real issue is a combination of low overall Black marriage rates, weak asset protection, and the absence of a coordinated strategy for retaining and compounding Black wealth. When out-marriage occurs alongside declining in-marriage and minimal financial planning, the community experiences capital leakage instead of circulation. If Black men married Black women at higher rates, protected assets through prenups and trusts, and intentionally reinvested in Black institutions, interracial marriage would not register as a crisis. It would simply be a personal choice within a strong, resilient system. The uncomfortable truth is this: marriage is not just about love. It is an economic contract, a wealth-building vehicle, and a power-transfer mechanism. When participation in that system becomes uneven, the effects are predictable — and they compound. Understanding that reality doesn’t require blame. It requires strategy. Focus Keyphrase: Black love and wealth Slug: black-men-interracial-marriage-impact-black-communityMeta Description: A data-driven look at how Black men marrying outside the race affects Black wealth, family formation, and long-term community power.

Why Millions of American Children Are Reading Below Grade Level — and How the System Failed Them

America is facing a crisis it doesn’t like to talk about because it exposes something deeper than test scores. Millions of children across the country are reading below grade level, and this is not a coincidence, a fluke, or the fault of parents who “didn’t try hard enough.” It is the predictable outcome of a system that stopped prioritizing literacy, accountability, and long-term outcomes—and replaced them with bureaucracy, shortcuts, and political comfort. Reading is not just another subject. Reading is the gateway skill. When children can’t read, they can’t fully access math, science, history, or even basic instructions. A child who struggles to read by third grade is statistically more likely to struggle for the rest of their academic life. By middle school, the gap widens. By high school, it calcifies. And by adulthood, it becomes an economic disadvantage that quietly follows them everywhere. This didn’t happen overnight. And it didn’t happen by accident. 1. The Alarming Reality No One Can Spin Away Across the United States, standardized assessments and independent studies show a staggering number of children reading below grade level. In some districts, the majority of students are behind. In others, the numbers are so normalized that failure has become expected instead of urgent. What’s worse is that many students are being promoted to the next grade without mastering basic reading skills. This practice—often justified as protecting self-esteem or avoiding stigma—does the opposite. It guarantees long-term struggle by delaying intervention until it’s too late to be easy. Social promotion doesn’t solve literacy gaps. It hides them. 2. How the Education System Let This Happen The modern American education system is overloaded with initiatives but underloaded with fundamentals. Over the past few decades, reading instruction shifted away from proven, structured phonics-based methods toward experimental approaches that assumed children would “naturally” pick up reading through exposure. That assumption was wrong. Many schools deprioritized explicit reading instruction, reduced time spent on foundational literacy, and failed to train teachers adequately in evidence-based methods. Add overcrowded classrooms, underpaid educators, and inconsistent curriculum standards across states, and the result is predictable: uneven outcomes and widespread reading failure. The system optimized for graduation rates and optics—not mastery. 3. Who This Failure Hurts the Most Systemic failure never lands evenly. Children from working-class families, low-income households, and historically marginalized communities are hit the hardest. When schools fail to teach reading well, families with resources compensate with tutors, private programs, and supplemental learning. Families without those resources are told to “trust the system.” That trust is expensive. Black children, in particular, are disproportionately affected—not because of ability, but because of access. When literacy instruction fails early, it limits academic tracking, reduces confidence, and narrows future opportunities. The result is a pipeline from poor literacy to limited career options that has nothing to do with intelligence and everything to do with neglect. 4. Technology Didn’t Save Reading — It Distracted From It Tablets, apps, and digital learning tools were sold as solutions. In reality, they often replaced direct instruction instead of supporting it. Screens do not teach children how to decode words, build vocabulary, or comprehend complex text without guidance. Reading is a human skill learned through repetition, feedback, and structure. No app replaces an adult who knows how to teach it correctly. The system mistook convenience for progress. 5. Why Waiting on Reform Is a Risk Families Can’t Afford Educational reform moves slowly. Children grow quickly. Every year a child remains behind in reading is a year that compounds difficulty across all subjects. Hoping the system “fixes itself” before your child reaches critical academic milestones is a gamble with long odds. Families who understand this are no longer waiting. 6. What Parents Must Do Now (Even If the System Doesn’t) This is the hard truth: literacy has become a family responsibility, not just a school one. That doesn’t mean parents failed. It means parents must adapt. Families can: Reading is the foundation of independence. A child who reads well can teach themselves anything else. Final Thought America doesn’t have a child intelligence problem. It has a systems problem. When millions of children can’t read at grade level, the issue isn’t effort—it’s design. Systems produce exactly the outcomes they are built for. And right now, this system is producing underprepared readers at scale. Families who recognize this early have an advantage. Not because they are better—but because they refuse to outsource their children’s future to a system that already showed its limits. Literacy is power.And power can’t be postponed. ❤️ Support Independent Black Media Black Dollar & Culture is 100% reader-powered — no corporate sponsors, just truth, history, and the pursuit of generational wealth. Every article you read helps keep these stories alive — stories they tried to erase and lessons they never wanted us to learn. Focus Keyphrase: children reading below grade level in AmericaSlug: why-american-children-reading-below-grade-levelMeta Description: Millions of American children are reading below grade level. This article explains how the education system failed them and what families must understand now.

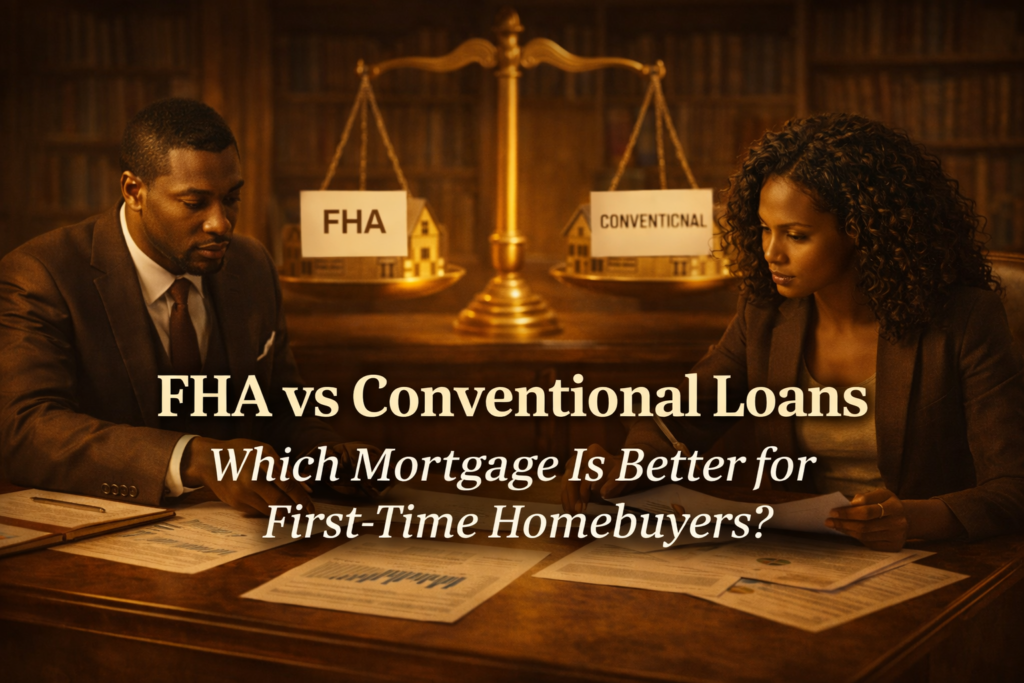

FHA vs Conventional Loans: Which Mortgage Is Better for First-Time Homebuyers?

Buying your first home isn’t just a milestone — it’s a financial fork in the road. Choose the right mortgage, and you build equity faster, save thousands in interest, and gain flexibility. Choose the wrong one, and you overpay for years without realizing why. Two options dominate the conversation for first-time buyers: FHA loans and conventional loans. Both can get you into a home. Only one may be right for your situation. Let’s break them down clearly. 1. What an FHA Loan Is (Plain English) An FHA loan is a mortgage backed by the Federal Housing Administration. It was designed to help buyers with lower credit scores or limited savings qualify for a home. Key traits: FHA loans are often marketed as the “starter” mortgage — and for some buyers, they are. 2. What a Conventional Loan Is A conventional loan is not backed by the government. It’s issued by private lenders and typically rewards borrowers with stronger credit and stable finances. Key traits: Conventional loans are often overlooked by first-time buyers who assume they don’t qualify — even when they do. 3. Down Payment Requirements Compared This is where most buyers focus first — sometimes too much. The difference is smaller than most people think. A lower down payment helps you get in the door, but it doesn’t tell the full cost story. 4. Credit Score Requirements This is where FHA loans shine — but with a tradeoff. If your credit is still recovering, FHA may be the bridge.If your credit is solid, conventional often wins long-term. 5. Mortgage Insurance: The Hidden Cost Most Buyers Miss This is the most important difference — and the one that costs people the most money. FHA Mortgage Insurance (MIP) Conventional Private Mortgage Insurance (PMI) Over time, FHA insurance can cost tens of thousands more than conventional PMI. 6. Monthly Payment Comparison Even with a similar home price: What looks cheaper upfront isn’t always cheaper long-term. 7. Long-Term Wealth Impact (This Is Where Strategy Matters) Homeownership isn’t just about getting approved — it’s about building equity efficiently. Conventional loans usually: FHA loans are better viewed as: Many smart buyers start FHA and later refinance into conventional — if they plan correctly. 8. Which Loan Is Better for First-Time Homebuyers? Here’s the honest answer: FHA May Be Better If: Conventional May Be Better If: The “best” loan isn’t universal.It’s situational. 9. The Biggest Mistake First-Time Buyers Make Most buyers ask: “Which loan gets me approved fastest?” Smarter buyers ask: “Which loan builds wealth with the least friction?” Approval is temporary.Mortgage costs are permanent. Final Thought FHA loans help people get in the game.Conventional loans help people win the game. The right move isn’t rushing into a mortgage — it’s choosing one that fits your credit today and your goals tomorrow. The difference can be tens of thousands of dollars — and years of progress. ❤️ Support Independent Black Media Black Dollar & Culture is 100% reader-powered — no corporate sponsors, just truth, history, and the pursuit of generational wealth. Every article you read helps keep these lessons alive — lessons they never wanted us to learn. Focus Keyphrase: FHA vs Conventional Loans for first-time homebuyersSlug: fha-vs-conventional-loans-first-time-homebuyersMeta Description: Compare FHA vs conventional loans to see which mortgage is better for first-time homebuyers, including down payments, credit requirements, mortgage insurance, and long-term costs.

How Black Americans Can Build Generational Wealth by Buying Assets During Economic Downturns

When the economy falls, most people freeze. The wealthy move. Every major fortune in American history was built during moments of fear—recessions, crashes, and downturns when prices were low and competition was scared. Economic downturns don’t destroy wealth. They transfer it. The question isn’t whether opportunity exists. The question is who is positioned to act. Assets don’t disappear in downturns. They get discounted. When markets fall: This is why the wealthy say, “Buy when there’s blood in the streets.” Not because they celebrate pain—but because pricing reflects emotion, not value. 2. The Assets That Matter Most During Downturns Not everything is worth buying just because it’s cheaper. Focus on assets that recover and compound. High-Priority Assets: Wealth is built by acquiring productive assets, not collectibles. 3. Cash Positioning Is the Real Advantage Downturns reward liquidity. Wealthy buyers prepare before crashes by: This allows them to act without panic. Cash doesn’t make you rich—but it lets you buy things that do. 4. Why Credit Access Separates Buyers From Spectators In downturns, banks tighten lending for most people— but extend favorable terms to strong borrowers. That’s why credit preparation matters: Credit is leverage. And leverage, used correctly, multiplies opportunity. 5. The Historical Pattern Black Families Must Understand History is clear: From land after the Civil War… to housing after 2008… to stocks after 2020… The tragedy wasn’t lack of opportunity. It was lack of access, preparation, and education. That’s changing now. 6. Ownership Beats Income Every Time Jobs pay bills. Ownership builds balance sheets. During downturns: This is why wealthy families prioritize what they own, not just what they earn. 7. What Stops Most People From Buying When It Matters The barriers are rarely financial. They’re psychological. Common blockers: The market doesn’t reward confidence. It rewards preparation. 8. A Simple Wealth-Building Playbook for Downturns You don’t need perfection. You need structure. Repeat this cycle across generations—not quarters. 9. Why This Moment Matters More Than Most America has entered a period of: These windows don’t stay open long. Those who move now build foundations. Those who hesitate pay premiums later. Final Thought The wealthy don’t wait for certainty. They wait for value. Economic downturns don’t signal the end of opportunity. They announce its arrival—quietly, briefly, and without warning. Those who understand this build legacies. Those who don’t fund them. ❤️ Support Independent Black Media Black Dollar & Culture is 100% reader-powered — no corporate sponsors, just truth, history, and the pursuit of generational wealth. Every article you read helps keep these lessons alive — lessons they never wanted us to learn. Focus Keyphrase: Black Americans build generational wealth during economic downturns Slug: how-black-americans-build-generational-wealth-economic-downturns Meta Description: Learn how Black Americans can build generational wealth by buying assets during economic downturns, when prices are lower and long-term opportunities are greatest.

Cleopatra VII: The Wealthiest Queen Rome Ever Feared

History remembers Cleopatra VII as a lover, a seductress, a woman whose power supposedly came from beauty and manipulation. That version of her story is convenient. It’s also a lie. Cleopatra VII was not dangerous because of romance. She was dangerous because she controlled one of the richest economies on Earth at the exact moment Rome was starving for resources, legitimacy, and money. Empires do not smear women they consider harmless. They rewrite the stories of rulers who threaten them. When Cleopatra took the throne of Egypt in 51 BCE, she inherited more than a crown. She inherited an economic machine that had fed civilizations for centuries. Egypt was not simply a kingdom; it was the financial backbone of the Mediterranean world. Its grain fields along the Nile supplied food to Rome’s swelling population. Its ports controlled trade routes between Africa, the Middle East, and Europe. Its treasuries held gold, silver, and state reserves accumulated over generations. Cleopatra did not stumble into power. She was trained from childhood to manage it. Unlike many rulers of her era, Cleopatra spoke multiple languages fluently, including Egyptian, Greek, and Latin. This was not a cultural flex; it was a strategic weapon. She could negotiate directly with merchants, diplomats, and military leaders without translators who diluted meaning or leaked information. She understood trade, taxation, logistics, and statecraft. Cleopatra ruled Egypt not as a figurehead but as a chief executive of a sovereign economic power. Rome, by contrast, was drowning in ambition and debt. Its military campaigns were expensive. Its political elite fought constantly for dominance. Its population depended heavily on Egyptian grain to avoid famine and unrest. Cleopatra knew this. She understood leverage better than most men who sat in the Roman Senate. Control the food, and you control the empire that eats it. When Julius Caesar entered her story, it was not romance that drew Cleopatra to him; it was survival and strategy. Egypt faced internal power struggles and Roman interference. Aligning with Caesar stabilized her throne and protected Egypt’s autonomy. In return, Rome gained access to Egypt’s resources under negotiated terms rather than outright conquest. Cleopatra used diplomacy to buy time, preserve sovereignty, and keep Egypt independent in a world where Rome swallowed kingdoms whole. After Caesar’s assassination, Cleopatra aligned with Mark Antony, not as a love-struck queen but as a ruler securing military protection and political balance. Together they controlled enormous territory, trade routes, and naval power. At their height, Cleopatra and Antony governed lands that rivaled Rome’s influence. This was not scandal; it was geopolitics. Rome did not panic because Cleopatra was charming. Rome panicked because she was effective. What followed was not merely a military conflict but a propaganda war. Octavian, later known as Augustus, understood that Rome could not admit it feared a foreign Black queen who commanded wealth, loyalty, and economic leverage. So he reframed the narrative. Cleopatra became painted as immoral, manipulative, and decadent. Antony was portrayed as weak and corrupted by foreign influence. This narrative justified Rome’s aggression and masked the truth: Rome crushed Egypt not to save morality, but to seize resources. After Cleopatra’s death, Egypt was absorbed into the Roman Empire. Its treasuries were looted. Its grain supply was nationalized for Rome’s benefit. The wealth Cleopatra once controlled now fed Roman dominance for generations. And just like that, history shifted its tone. Cleopatra’s intelligence was erased. Her financial mastery was ignored. Her leadership was reduced to gossip. But facts do not disappear simply because empires prefer myths. Cleopatra VII ruled one of the richest states in human history. She controlled food, trade, gold, language, and diplomacy with precision. She understood that power is not loud; it is organized. And that is why Rome destroyed her image after destroying her kingdom. They could defeat her militarily, but they could not allow future generations to understand what she truly represented: a sovereign ruler who proved that wealth, intelligence, and strategy are far more threatening than swords. Cleopatra’s legacy is not romance. It is a lesson. Those who control resources shape the world, and those who challenge empires rarely get fair biographies. History often belongs to the victors, but wealth always leaves a trail. And if you follow the money, the grain, and the power, you find Cleopatra VII exactly where Rome feared her most — at the center of the economic world. ❤️ Support Independent Black Media Black Dollar & Culture is 100% reader-powered — no corporate sponsors, just truth, history, and the pursuit of generational wealth. Every article you read helps keep these stories alive — stories they tried to erase and lessons they never wanted us to learn. Focus Keyphrase: Cleopatra VII wealth and power Slug: cleopatra-vii-wealth-power-rome Meta Description: Cleopatra VII was not just a queen but a powerful economic strategist who controlled Egypt’s wealth, trade, and grain supply—making her one of the most feared rulers Rome ever faced.