Bessie Coleman: The Woman Who Refused to Stay Grounded

Bessie Coleman was born on January 26, 1892, in Atlanta, Texas, at the intersection of poverty, racism, and rigid limitation. She was the tenth of thirteen children born to George and Susan Coleman, a family of sharecroppers whose lives were shaped by the unforgiving realities of post-Reconstruction America. Cotton fields, long days, and scarce opportunity defined her early years. Education existed, but barely—one-room schoolhouses, worn textbooks, and interrupted learning whenever farm labor demanded it. Yet even in those conditions, Bessie showed an early hunger for knowledge, discipline, and something beyond the horizon. Her father eventually left the family, returning to Indian Territory in Oklahoma in search of a better life, while Bessie remained with her mother, helping raise her siblings and working the fields. Poverty was not an abstract concept to her; it was lived daily. But so was resilience. She excelled in school when she could attend, eventually saving enough money to enroll at Langston University in Oklahoma. Her time there was short—financial hardship forced her to withdraw—but the seed of ambition had already taken root. She would not accept a life dictated by circumstance. In her early twenties, Bessie moved to Chicago, joining the Great Migration of Black Americans seeking opportunity beyond the South. There, she worked as a manicurist, a job that placed her in close proximity to conversation, news, and stories from beyond her world. It was in a barbershop that her life took its decisive turn. She listened as Black men returned from World War I spoke of flying in Europe. They talked about airplanes, freedom, and skies that did not feel segregated. Her brothers, particularly one who had served in France, taunted her—telling her that French women could fly planes while American Black women could not. Instead of discouraging her, the insult ignited something irreversible. Bessie Coleman decided she would fly. The problem was America had no intention of letting her do so. Every aviation school she applied to rejected her. The rejections were absolute—no appeals, no alternatives. She was dismissed not for lack of intelligence or ability, but because she was both Black and a woman. In the early 20th century, flight was considered the domain of white men only. Rather than accept the denial, Bessie made a decision that defined her legacy: if America would not teach her, she would leave America. She enrolled in French language classes, saved her earnings meticulously, and gained sponsorship from influential Black newspapers, including the Chicago Defender. In 1920, she sailed to France. This alone was radical—an unmarried Black woman traveling abroad for professional training at a time when many Americans never left their home counties. In France, she trained at the Caudron Brothers’ School of Aviation, one of the most respected flight schools in the world. Flying in the 1920s was not glamorous. Planes were unstable, cockpits open to the elements, and crashes common. Training involved risk at every step. Bessie endured crashes, injuries, and intense discipline. But she persisted. On June 15, 1921, she earned her international pilot’s license from the Fédération Aéronautique Internationale, becoming the first Black woman in the world to do so—and one of the first Americans of any race to hold that distinction. When Bessie returned to the United States, her achievement should have made her a national hero. Instead, she encountered the same walls she had left behind. Airlines would not hire her. Commercial aviation opportunities were closed. Once again, racism tried to ground her ambitions. This time, she refused to stop moving forward. Bessie turned to barnstorming—performing aerial stunts at airshows across the country. Loop-the-loops, dives, figure-eights—she mastered them all. But her performances were not about spectacle alone. They were statements. Every time she climbed into a cockpit, she challenged the idea that Black people belonged only on the ground. She attracted massive crowds, especially in Black communities, where many had never seen an airplane up close, let alone one piloted by a Black woman. She was also uncompromising in her principles. Bessie refused to perform at venues that enforced segregated seating. If Black spectators were forced to enter through back gates or sit separately, she would not fly. This stance cost her income and opportunities, but she would not trade dignity for exposure. To her, flight symbolized freedom, and freedom could not exist alongside humiliation. Her vision extended far beyond stunt flying. Bessie dreamed of opening a flight school for Black aviators—men and women—so future generations would not have to leave the country to learn what she had fought to access. She spoke publicly about this goal, emphasizing education, discipline, and ownership of the skies. She wanted Black pilots, Black mechanics, Black instructors—an aviation ecosystem independent of exclusionary systems. Tragically, that dream was cut short. On April 30, 1926, in Jacksonville, Florida, Bessie Coleman boarded a plane for a practice flight ahead of an upcoming airshow. The aircraft was piloted by her mechanic, William Wills. Bessie was not wearing a seatbelt because she was scouting the terrain below, preparing for a parachute jump she planned to perform later. Mid-flight, the plane experienced a mechanical failure—later determined to be caused by a loose wrench lodged in the engine. The aircraft went into a sudden nosedive. Bessie was thrown from the plane at 2,000 feet and died instantly. She was 34 years old. Moments later, the plane crashed, killing Wills as well. Her death sent shockwaves through Black communities across the country. Thousands attended her funeral in Chicago. Leaders, activists, and ordinary people mourned not just the loss of a woman, but the loss of a future she represented. She died without ever opening the flight school she envisioned, without seeing the aviation doors she cracked open fully swing wide. Yet her impact did not end with her life. Bessie Coleman became a symbol—of courage without permission, of ambition without apology. Her legacy inspired future generations of Black aviators, including the Tuskegee Airmen during World War II. Pilots flew in her honor. Schools, clubs, and scholarships were named

The Rubber That Bled Africa: How the Congo Funded Europe’s Rise

Europe’s modern rise did not begin in factories, parliaments, or banks. It began in the forests of Central Africa, where rubber vines wrapped around trees and human suffering wrapped around an entire civilization. Long before automobiles rolled across paved streets and before electricity lit European cities, the Congo was being drained—slowly, violently, and deliberately—to fuel an empire that the world would later call “progress.” In the late 1800s, as Europe raced into the Industrial Age, rubber became one of the most valuable resources on Earth. It powered bicycle tires, automobile wheels, electrical insulation, machinery belts, and military equipment. Demand exploded almost overnight, and with it came a question that Europe was determined to answer at any cost: where would the rubber come from? The answer was the Congo. What made the Congo especially vulnerable was not just its natural abundance, but its political erasure. At the Berlin Conference of 1884–85, European powers carved Africa into territories without African consent or presence. In one of history’s most grotesque land grabs, the Congo did not even become a Belgian colony at first—it became the personal property of King Leopold II of Belgium. A single man claimed control over a landmass nearly the size of Western Europe and renamed it the Congo Free State, though nothing about it was free. Leopold never set foot in the Congo. He did not need to. He ruled through violence, quotas, and terror, building a system that turned African lives into units of production. Villages were ordered to meet rubber quotas extracted from wild vines deep in the jungle. Failure was punished brutally. Hands were severed to prove bullets had not been wasted. Families were taken hostage. Entire communities were burned. Fear became policy. Violence became management. The rubber that arrived in Europe carried no visible bloodstains, but it was soaked in them. Each shipment represented countless hours of forced labor, starvation, mutilation, and death. Historians estimate that between 10 and 15 million Congolese people perished during Leopold’s rule—through execution, exhaustion, famine, and disease. This was not accidental. It was the cost of doing business. Meanwhile, Europe flourished. Belgium transformed. Infrastructure expanded. Wealth accumulated. Banks grew stronger. Industries advanced. Rubber profits poured into European development while Congo villages collapsed into silence. Roads and railways were built, not to connect African communities, but to remove resources faster. The Congo was never meant to be developed—only emptied. What made the system especially insidious was how it was marketed. Leopold presented himself to the world as a humanitarian, claiming to bring civilization, Christianity, and order to Africa. European newspapers repeated the lie. Investors believed it. Governments tolerated it. The suffering of African people was buried beneath propaganda and distance, hidden behind the language of “trade” and “progress.” But the truth could not stay hidden forever. Missionaries, journalists, and whistleblowers began documenting the atrocities. Photographs of mutilated Congolese men, women, and children leaked into the global consciousness. Testimonies described villages erased for missing quotas. International outrage grew. Eventually, pressure mounted enough that Belgium stripped Leopold of his personal control in 1908, officially turning the Congo into a Belgian colony. Yet the system did not disappear—it evolved. Forced labor continued under different names. Resource extraction persisted. Wealth still flowed outward, never inward. The rubber economy faded only when Southeast Asia began producing rubber more cheaply, not because African lives had suddenly gained value, but because exploitation found a more efficient location. Europe’s industrial foundations, however, were already laid. The bicycles, cars, machines, and infrastructure that symbolized modernity were built on African suffering that history textbooks rarely emphasize. Rubber was not just a material—it was a transfer of wealth, power, and future. The Congo lost generations. Europe gained centuries. Today, when people speak of Africa’s “underdevelopment,” they rarely mention how development was removed. They ask why nations struggle without acknowledging that their wealth was exported at gunpoint. The Congo was not poor—it was plundered. Its people were not unproductive—they were enslaved. Its land was not empty—it was emptied. And rubber was only the beginning. The same patterns would repeat with minerals, oil, gold, diamonds, and now the materials powering modern technology. The Congo continues to supply the world while remaining among the poorest nations on Earth, trapped in cycles designed long before independence. To understand Europe’s rise without understanding Congo’s suffering is to accept a lie. Progress did not happen in isolation. It happened through extraction, violence, and silence. The rubber that cushioned Europe’s journey into modernity crushed African lives beneath it. History remembers the factories. It remembers the kings. It remembers the empires. But it must also remember the blood-soaked vines in the Congo forests—where Africa bled so the modern world could move.

Why Saving Alone Will Never Make You Rich

Saving money is responsible.Saving money is disciplined.Saving money is necessary. But saving money—by itself—has never been the path to real wealth. That truth is uncomfortable because for generations, especially in working families, saving was taught as the finish line. “Put money away.” “Don’t spend it.” “Build a nest egg.” Those habits are important, but they are incomplete. And in today’s economy, they are dangerously incomplete. Saving Preserves Money — It Does Not Multiply It Saving is defensive.Wealth is offensive. When you save, you are protecting money you already earned. When you build wealth, you are putting money to work so it produces more money without requiring more labor from you. A savings account does one job well: it prevents loss.It does not create growth. Inflation quietly erodes the value of saved cash every year. Even “high-yield” savings accounts usually struggle to outpace the rising cost of living over long periods. This means that money sitting still is, in real terms, often moving backward. Saving keeps you stable.It does not make you free. The Wealthy Use Saving as a Starting Point, Not a Strategy Wealthy households save—but they don’t stop there. They save to deploy.They save to invest.They save to acquire assets. Savings is the staging area. Assets are the engine. Stocks, businesses, real estate, and ownership stakes are what compound over time. These assets grow, generate income, and expand purchasing power. They turn time into an ally. If your money is not growing while you sleep, it is falling behind while you work. Income Is Temporary. Systems Are Permanent. Most people are trained to think linearly:Work → Get paid → Save → Repeat That loop creates stability, not wealth. Wealth is built through systems that operate independently of your daily effort:• Automated investing• Ownership structures• Compounding returns• Tax-advantaged accounts• Reinvested profits Saving without a system is like collecting seeds and never planting them. The Real Risk Isn’t Investing — It’s Standing Still Many people avoid investing because it feels risky. Market ups and downs look scary. But the biggest long-term risk is guaranteed stagnation. Cash loses value slowly and silently.Assets fluctuate but grow over time. Avoiding risk entirely doesn’t eliminate danger—it simply chooses a slower, quieter form of loss. The wealthy understand this distinction. They don’t chase excitement. They structure exposure. They manage risk with diversification, time horizons, and discipline. Saving Buys Time. Assets Buy Freedom. Saving gives you breathing room.Assets give you leverage. Saving helps you survive emergencies.Assets help you escape dependency. This is why people can save for decades, retire with a respectable balance, and still worry about running out of money. They protected income—but never replaced it. True wealth replaces labor with ownership. The Shift That Changes Everything The question is not:“How much should I save?” The better question is:“What system will turn my savings into ownership?” Saving is step one.Investing is step two.Ownership is the destination. Those who stop at step one remain disciplined workers.Those who complete the journey become builders of legacy. Slug: why-saving-alone-will-never-make-you-richMeta Description: Saving money is important, but it will never make you rich by itself. Learn why wealth is built through systems, assets, and ownership—not just discipline.

Robert Reed Church: The Black Man Who Became the South’s First Millionaire After Slavery

They don’t teach this story in schools because it disrupts a lie that America has spent centuries protecting—the lie that Black people never built wealth on their own, never mastered systems, never owned power before it was taken from them. Robert Reed Church did all three. Born enslaved in Mississippi in 1839, Robert Reed Church entered the world as property. His mother was enslaved. His father was a white steamboat captain who never publicly claimed him but quietly ensured that Church learned something most enslaved people were denied—how money moved. By the time emancipation arrived, Church was no longer just free. He was prepared. While many newly freed Black Americans were pushed into sharecropping—a system designed to trap them in permanent debt—Church made a different decision. He went where money flowed: the Mississippi River. As a young man, he worked on steamboats, not just as labor but as a businessman. He learned routes. He learned trade. He learned leverage. And most importantly, he learned land. After the Civil War, Memphis was chaos. Disease, political instability, and racial violence made white property owners panic. During the yellow fever epidemics of the 1870s, thousands fled the city. Property values collapsed. White landowners sold prime real estate for pennies just to escape. Robert Reed Church saw opportunity where others saw collapse. With cash saved from years of disciplined work and investing, Church bought land—lots of it. Downtown Memphis. Beale Street. Commercial corridors. Not farmland. Not scraps. Prime urban real estate. While others speculated, he owned. By the 1880s, Church was the largest Black landowner in the South. By the 1890s, he was worth over one million dollars—making him the first Black millionaire in the South after slavery, at a time when lynchings were public entertainment and Jim Crow was tightening its grip. But Church didn’t just build wealth for himself. He understood something most wealthy people do: money without community is fragile. He invested heavily in Black Memphis. He built Church Park and Auditorium, one of the largest Black-owned entertainment venues in the country. It hosted concerts, political meetings, conventions, and speeches by leaders like Booker T. Washington. When Black people were locked out of public spaces, Church created their own. He financed Black businesses when banks refused. He backed schools when the state neglected them. He used his influence to protect Black institutions during periods of racial terror—not with speeches, but with ownership and political pressure. And then came 1892. That year, Memphis exploded with racial violence after the lynching of three successful Black businessmen. Many Black residents fled the city, fearing massacre. Again, white landowners sold. Again, Robert Reed Church bought. His wealth grew not from exploitation—but from discipline, timing, and understanding systems. Church also understood legacy. His son, Robert Reed Church Jr., became one of the most powerful Black political figures in America, helping found the NAACP and turning Memphis into a center of Black political organization. This was not accidental. This was design. Robert Reed Church died in 1912, but his blueprint remains painfully relevant today. He proved that Black wealth was never impossible—only interrupted. He proved that land ownership is power. He proved that economic independence is louder than protest. And he proved that when Black people are allowed—even briefly—to operate without sabotage, they build cities. They erased his name because his existence is evidence. Evidence that Black Wall Streets didn’t appear by accident.Evidence that wealth can be built even in hostile systems.Evidence that the problem was never Black ability—but white interference. Robert Reed Church didn’t beg for inclusion. He bought the ground beneath the system—and stood on it. SEO Elements Slug:robert-reed-church-first-black-millionaire-south Meta Description:The untold story of Robert Reed Church, the first Black millionaire in the South after slavery, who built wealth through land ownership, discipline, and economic independence in Memphis.

Why Working Hard Will NOT Make You Rich in 2026 (And What Actually Will)

For decades, we were taught a simple formula: work hard, stay loyal, and success will follow. That belief built careers, powered families, and shaped entire generations. But in 2026, that formula is officially broken. Not because people are lazy, but because the economy has fundamentally changed. Millions of people are working harder than ever before — multiple jobs, longer hours, constant side hustles — yet they are further away from wealth than their parents were. The problem isn’t effort. The problem is where effort is being applied. In 2026, hard work alone no longer creates wealth. Ownership, leverage, and systems do. This article breaks down exactly why working hard will not make you rich anymore — and what actually will. 1. Income Is No Longer Wealth (It’s a Temporary Tool) In the old economy, income was enough. Raises kept pace with inflation, pensions existed, and loyalty was rewarded. In 2026, income is fragile. Income today is rent, not ownership. The moment your labor stops, the money stops. Wealth, on the other hand, continues working whether you show up or not. If your entire financial life depends on a paycheck, you are one missed check away from stress — no matter how hard you work. 2. Hard Work Without Leverage Caps Your Ceiling Leverage is the multiplier that separates effort from wealth. Hard work is linear: Leverage is exponential: In 2026, wealthy individuals do not trade time for money. They use: This is why a warehouse worker can work 60 hours a week while a business owner earns more while sleeping. It’s not about who works harder — it’s about who controls the system. 3. The System Rewards Owners, Not Workers The modern economy is designed to reward ownership. Always has been. Consider who benefits most from: Not employees. Owners earn: Workers earn wages — and wages are taxed first and hardest. In 2026, if you do not own assets, you are funding someone else’s wealth with your labor. 4. AI and Automation Have Changed the Game Forever Artificial intelligence didn’t just change jobs — it changed value. Tasks that once required: Can now be done faster and cheaper by software. This doesn’t mean humans are useless. It means routine labor is losing value while strategy, ownership, and creativity gain value. Hard work used to be rare. In 2026, effort is abundant — and abundance drives prices down. What is scarce now? That’s where wealth flows. 5. Time Is the Most Expensive Currency — And Workers Sell It Cheap Time is finite. Wealthy people protect it. Workers are trained to sell time cheaply: Owners invest time once to create assets that pay repeatedly. When you trade time for money forever, you cap your future. When you invest time into assets, you build freedom. In 2026, the question is no longer “How hard do you work?”It’s “What will still pay you five years from now?” 6. Taxes Punish Earners and Reward Owners One of the most uncomfortable truths is that the tax code is not neutral. Earned income: Asset income: This is why wealthy families focus on: While workers are stuck chasing raises that vanish after taxes and inflation. Hard work alone puts you in the most expensive tax category. 7. Wealth in 2026 Is Built Through Systems, Not Sweat What actually creates wealth today? These are systems, not jobs. Systems don’t get tired.Systems don’t age.Systems don’t need permission to grow. Hard work is still required — but only at the front end. After that, systems replace sweat. 8. The Shift From Labor to Ownership Is Mandatory In 2026, wealth is no longer optional knowledge. It is survival knowledge. Those who understand ownership will: Those who don’t will: This isn’t about abandoning work ethic. It’s about redirecting effort. Hard work should be used to: Not just pay bills. 9. What Actually Makes People Rich in 2026 Here’s what consistently builds wealth now: Wealth is quiet. It compounds. It doesn’t announce itself. Final Truth: Hard Work Is Still Required — Just Not Alone Working hard is not useless. It’s just incomplete. Hard work without ownership builds someone else’s dream.Hard work with ownership builds legacy. In 2026, the people who win are not the ones who grind the most — they are the ones who build, own, and control. The era of “just work harder” is over. The era of ownership has begun. ❤️ Support Independent Black Media Black Dollar & Culture is 100% reader-powered — no corporate sponsors, just truth, history, and the pursuit of generational wealth. Every article you read helps keep these stories alive — stories they tried to erase and lessons they never wanted us to learn. Slug: why-working-hard-will-not-make-you-rich-2026Meta Description: Working hard alone won’t make you rich in 2026. Learn why income is no longer enough and what actually builds wealth today: ownership, leverage, and systems.

How a Roth IRA Can Make Your Family Rich (Not Just Comfortable)

Most families chase income.Wealthy families build systems. A Roth IRA is one of the most powerful—and most misunderstood—systems available to everyday people. Used correctly, it doesn’t just help you retire comfortably. It can quietly turn your household into a multi-generation wealth engine. Let’s break down exactly how. 1. A Roth IRA Grows Tax-Free Forever • Contributions are made with after-tax dollars• Investments grow tax-free• Withdrawals in retirement are 100% tax-free This matters because taxes are the silent killer of wealth.Every dollar that avoids taxation compounds faster—and compounding is how families get rich slowly, then suddenly. 2. Time Turns Small Contributions Into Large Outcomes • $6,500 per year sounds small• 30–40 years of compounding is massive• Growth beats hustle when time is on your side A family that starts early doesn’t need luck, crypto bets, or viral income. Time does the heavy lifting. 3. Roth IRAs Protect You From Future Tax Increases • No one knows future tax rates• Governments historically raise taxes• Roth IRAs lock in today’s tax rate forever This is wealth defense.You pay taxes once—on your terms—and never again. 4. You Can Pass a Roth IRA to Your Children • Roth IRAs can be inherited• Heirs receive tax-free growth• Funds can stretch across years This is how wealthy families move money forward without erosion. Not through income—but through ownership structures. 5. Roth IRAs Work Perfectly With Family Banks & Trusts • Roth IRAs pair well with trusts• They fit inside Family Bank strategies• They protect wealth from mismanagement This is how money stays in the family longer than one generation. 6. You Can Invest the Roth IRA—It’s Not a Savings Account • Stocks• ETFs• Index funds• Dividend assets The Roth IRA is a container, not an investment.What you put inside determines how powerful it becomes. 7. The Real Secret: It Teaches Discipline, Not Just Returns • Automatic investing• Long-term thinking• Delayed gratification Families who win financially think decades ahead. A Roth IRA trains that mindset quietly, year after year. 8. This Is How Rich Families Think Rich families don’t ask: “How much can I make this year?” They ask: “How do I protect and multiply money for the next 40 years?” A Roth IRA answers that question. Final Thought You don’t need millions to start acting wealthy.You need structures, time, and discipline. A Roth IRA isn’t flashy.It’s not loud.But it’s one of the cleanest tools ever created for turning income into legacy. 📌 Focus Keyphrase How a Roth IRA can make your family rich 🔗 Slug how-a-roth-ira-can-make-your-family-rich 📝 Meta Description Learn how a Roth IRA can quietly build tax-free, generational wealth for your family using time, discipline, and smart investing strategies.

Wealth Isn’t Loud: Why Quiet Wealth Building Always Wins

Wealth isn’t loud.It doesn’t announce itself.It doesn’t beg for attention.It compounds—quietly. In today’s world, loud money is often mistaken for real success. Social media has trained us to believe that wealth must be visible to be valuable. But history, finance, and lived experience prove otherwise. Quiet wealth building has always been the most powerful path to lasting financial freedom. Quiet wealth doesn’t seek validation. It doesn’t rely on applause or approval. Instead, it focuses on ownership, discipline, and time. While loud money performs, quiet wealth compounds. Why Quiet Wealth Building Matters Quiet wealth building prioritizes long-term outcomes over short-term attention. It looks like investing consistently, even when no one is watching. It looks like choosing assets over liabilities and patience over impulse. Most people overlook quiet wealth because it appears slow. But compounding is deceptive. What starts small grows powerful with consistency. Quiet wealth building rewards those who stay disciplined while others chase trends. The Difference Between Loud Money and Real Wealth Loud money demands to be seen. It shows up as flashy spending, constant upgrades, and public flexing. But loud money often fades quickly because it is built on consumption, not ownership. Quiet wealth building creates options. It creates freedom of movement, financial security, and generational stability. Real wealth is measured not by what you display, but by what you control. Why Quiet Wealth Has Always Been a Black Strategy Historically, Black wealth had to move quietly. From mutual aid societies to land ownership and community banking, quiet wealth building was a matter of survival. Visibility often meant risk. Silence meant protection. That strategy still applies today. Quiet wealth building allows families to grow resources, protect assets, and build legacy without unnecessary exposure. Compounding: The Power Behind Quiet Wealth Compounding is the engine of quiet wealth building. It turns consistency into momentum and patience into power. Whether through investments, businesses, or ownership, compounding rewards those who think long-term. Quiet wealth doesn’t rush. It doesn’t panic. It doesn’t chase attention. It compounds steadily—until it no longer needs to explain itself. The Black Dollar & Culture Philosophy At Black Dollar & Culture, we believe real wealth moves in silence. It is strategic, disciplined, and intentional. Quiet wealth building is not about looking rich—it’s about staying powerful. Not loud.Not flashy.Not rushed. Just consistent. Strategic. And compounding quietly. 🔑 Focus Keyphrase Quiet wealth building wealth-isnt-loud-it-compounds-quietly Quiet wealth building is how real money lasts. Learn why wealth isn’t loud, how compounding works, and why silence builds lasting power.

Why the Media Won’t Talk About Black Economic Power

The silence is intentional. While headlines obsess over Black struggle, debt, and disparity, something far more disruptive is happening just beneath the surface: Black economic power is growing—quietly, strategically, and faster than the narrative allows. Not in the loud, flashy way the media prefers, but in a disciplined, ownership-focused way that doesn’t beg for validation. And that is precisely why it isn’t covered. For decades, Black progress has been framed through a narrow lens of hardship. The story rarely evolves. When it does, it is usually softened, minimized, or quickly redirected back to inequality. What is almost never explored is the shift from income to ownership, from consumption to control, from survival to strategy. Yet across the country, Black families are buying businesses instead of brands, assets instead of applause, and influence instead of attention. The media thrives on predictability. Struggle fits. Power complicates things. Economic power forces new questions—about systems, access, and who benefits when narratives change. It challenges advertisers who profit from insecurity. It disrupts political talking points that rely on dependency. And it undermines the long-standing myth that Black progress only happens when it is granted, approved, or overseen. Look closer and the shift becomes undeniable. Black entrepreneurship has surged, not just in numbers but in sophistication. We’re seeing acquisitions, not just startups. We’re seeing families pooling capital, not individuals chasing clout. We’re seeing a growing interest in trusts, private equity, insurance strategies, land, logistics, and digital infrastructure. These are not the moves of a community “catching up.” These are the moves of a community recalibrating how power actually works. What makes this moment especially dangerous to the old narrative is that it is decentralized. There is no single leader to discredit, no single movement to co-opt, no single celebrity to spotlight and exhaust. It is happening in households, group chats, private study circles, barbershops, church basements, Discord servers, and dinner tables. Quiet wealth is harder to attack because it does not announce itself. The media also struggles to report on things it doesn’t fully understand—or control. Ownership doesn’t trend the way outrage does. Long-term planning doesn’t generate clicks like controversy. A family buying a warehouse, a logistics route, or an insurance policy that funds future generations doesn’t make for dramatic television. But it reshapes reality far more than viral moments ever could. There is another reason for the silence, one that is rarely said out loud. Black economic power changes leverage. It changes how communities negotiate, where they live, what they tolerate, and what they walk away from. It changes voting behavior, schooling choices, healthcare decisions, and labor dynamics. A population with options is harder to manage. A population with assets is harder to pressure. A population that understands money is harder to mislead. This is why the focus remains on income gaps instead of asset gaps. Income can be taxed, inflated away, and capped. Assets endure. Assets appreciate. Assets talk back. When Black families begin to understand this distinction at scale, the entire economic conversation shifts. And that shift does not benefit institutions that profit from confusion. Even the language used tells the story. The media speaks endlessly about “spending power” but avoids “ownership power.” Spending power frames Black consumers as valuable only at the register. Ownership power frames Black people as stakeholders—people who collect, not just contribute. One narrative is safe. The other is transformative. What’s happening now didn’t come from nowhere. It is the result of hard lessons learned across generations. It is the response to watching wealth extracted, neighborhoods flipped, and labor undervalued. It is the realization that visibility without ownership is a trap, and representation without control is theater. So the strategy changed. Less talking. More building. And because it doesn’t fit the expected storyline, it’s easier for the media to pretend it isn’t happening. Silence becomes a form of denial. Omission becomes a way to preserve the illusion that nothing has fundamentally changed. But it has. The irony is that by ignoring Black economic power, the media is making it stronger. What grows quietly often grows sturdier. What isn’t spotlighted isn’t sabotaged as easily. While attention is elsewhere, foundations are being laid that don’t need applause to function. Black Dollar & Culture exists to document this shift—not as hype, not as fantasy, but as fact. The goal isn’t to convince skeptics. It’s to inform builders. To connect dots. To remind people that power doesn’t ask to be acknowledged. It simply moves. The media will talk about Black economic power when it becomes unavoidable. When it disrupts markets. When it alters politics. When it refuses to behave the way it’s “supposed” to. Until then, the silence tells you everything you need to know. What they don’t talk about is often what matters most. Slug: why-the-media-wont-talk-about-black-economic-powerMeta Description: Black economic power is growing faster than the media admits. Discover why ownership, assets, and quiet wealth-building are changing the narrative—and why it’s being ignored.

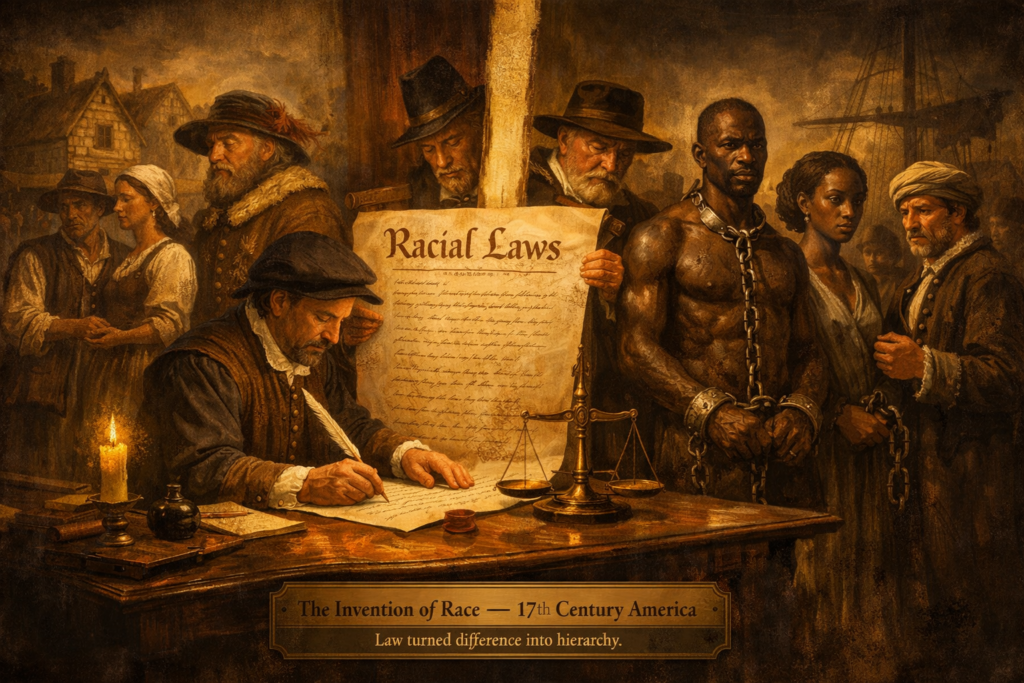

How “White” Was Invented — And How Black People Were Branded in the Process

Before America existed, before plantations, before racial laws, and before the word “white” ever carried meaning, Europe was already brutal—but not divided by skin color. It was divided by power. In medieval Europe, no one woke up calling themselves white. That identity did not exist. A poor English farmer had nothing in common with a wealthy English lord, and no amount of shared skin tone could bridge that gap. Identity came from land, lineage, loyalty, and religion. You were Saxon or Norman, Irish or Frank, Catholic or Protestant, noble or peasant. Those labels determined your fate far more than complexion ever did. Most Europeans lived under a rigid system of hierarchy where kings and nobles owned land and everyone else existed to serve it. Serfs were bound to estates they would never own, working fields they could never profit from, paying taxes they could never escape. Their lives were short, their labor exploited, and their bodies disposable. Poverty was inherited. Wealth was protected. Freedom was rare. A peasant in England was closer in social status to an enslaved laborer than to a noble of his own nation. Religion sharpened these divisions even further. In Europe, belief defined belonging. Christian versus Muslim. Catholic versus Protestant. Christian versus Jewish. During the centuries when Africans and Arabs ruled much of Spain under Al-Andalus, darker-skinned people governed some of the most advanced cities in Europe. Cordoba and Granada had paved streets, libraries, and universities while much of northern Europe remained illiterate and rural. But when Christian kingdoms reclaimed Iberia during the Reconquista, they did more than seize land. They introduced a dangerous idea that would later shape the modern world: purity of blood. Spain’s “limpieza de sangre” system judged people not just by belief, but by ancestry. Converted Christians with African or Jewish lineage were still considered tainted. This was not yet whiteness, but it was the blueprint. Bloodlines were being ranked. Worth was becoming inherited. Humanity was being filtered through ancestry rather than character or faith. At the same time, Europeans themselves were being enslaved. Long before the transatlantic slave trade, bondage in Europe was common. Vikings captured and sold other Europeans across trade routes. Slavic peoples were enslaved so frequently that their name became the root of the word “slave.” Along the North African coast, thousands of Europeans were taken during raids and forced into labor within the Ottoman world. Enslavement was not racial—it was about power. Whoever controlled land, weapons, and law decided who was free. Everything changed when Europe reached the Americas. Colonial elites quickly learned a dangerous lesson: poor Europeans and Africans working together were a threat. Uprisings like Bacon’s Rebellion revealed that class solidarity could destabilize colonial power. The response was not justice, but invention. A new identity was created—one that had never existed before. “White.” Whiteness was not culture. It was not heritage. It was law. Colonial governments passed statutes that granted poor Europeans small privileges—access to land, lighter punishments, legal protections—while Africans were stripped of humanity permanently. Slavery became lifelong. Slavery became inherited. Freedom became tied to skin color. The racial categories of “white” and “black” were born together, serving opposite purposes within the same system. This invention worked exactly as intended. It divided laborers who might have united. It redirected anger away from elites and toward the enslaved. It gave poor Europeans a psychological wage in place of real economic power. They were no longer peasants or servants—they were white. And that label carried just enough status to protect the system that continued to exploit them. This is why understanding history matters. Because race was never about biology. It was about control. Whiteness was created to protect wealth, not people. Blackness was imposed to justify extraction, exploitation, and permanent subjugation. Once you understand this, the modern world begins to make sense—from wealth gaps to policing, from labor inequality to global power structures. The story we were taught was incomplete by design. But when you trace it back far enough, the truth becomes unavoidable. Race didn’t create hierarchy.Hierarchy created race. ❤️ Support Independent Black Media Black Dollar & Culture is 100% reader-powered — no corporate sponsors, just truth, history, and the pursuit of generational wealth. Every article you read helps keep these stories alive — stories they tried to erase and lessons they never wanted us to learn. Hashtags#BlackHistory #HiddenHistory #RaceWasInvented #Whiteness #BlackDollarAndCulture #Colonialism #PowerStructures #EconomicHistory #TruthOverMyths #GlobalHistory Slug:how-whiteness-was-invented-and-how-black-people-were-branded Meta Description:Discover how race was invented to protect power—how Europeans became “white,” how Black people were branded, and how hierarchy shaped the modern world.

Amenhotep III: The African Pharaoh Who Ruled Egypt at Its Absolute Peak

Long before decline, invasion, and distortion crept into the historical record, there was a moment when Egypt stood uncontested—politically, economically, culturally, and spiritually. That moment belonged to Amenhotep III. His reign was not built on constant warfare or desperate expansion, but on something far rarer in the ancient world: total dominance so complete that peace itself became a symbol of power. Under Amenhotep III, Egypt did not merely survive history—it defined it. He ascended the throne in the 14th century BCE, inheriting a kingdom already strong, but what he transformed it into was unprecedented. Egypt became the axis of the known world. Gold flowed through its cities like blood through arteries. Foreign kings did not challenge Egypt—they courted it. They sent tribute, daughters, luxury goods, and diplomatic letters not as equals, but as petitioners seeking favor from the African superpower seated along the Nile. This was not accidental. Amenhotep III ruled during a time when Nubian gold mines were fully operational, giving Egypt control over the most valuable resource of the Bronze Age. Gold was not symbolic—it was structural. It funded architecture on a scale never seen before, paid craftsmen whose skills bordered on divine, and allowed Egypt to project power without raising a sword. Where other empires conquered through fear, Egypt under Amenhotep III conquered through gravity. Everything was pulled toward it. The monuments tell the story even when the texts are ignored. Colossal statues rose from the earth not as propaganda, but as statements of reality. Temples were not hurried structures of defense but carefully planned expressions of eternity. The Colossi of Memnon—towering figures seated in silence—were not meant to intimidate enemies. They were meant to remind the world that Egypt, and its king, were permanent. These were not the works of a kingdom bracing for collapse, but of one utterly confident in its place atop human civilization. Amenhotep III did something few rulers in history ever achieved: he ruled so well that war became unnecessary. His foreign policy was built on diplomacy, marriage alliances, and economic leverage. The Amarna Letters—diplomatic correspondence between Egypt and other great powers—reveal foreign rulers openly begging for gold, addressing the pharaoh as a brother while knowing full well the imbalance between them. Babylon, Mitanni, Assyria—names that loom large in ancient history—all acknowledged Egypt’s supremacy during his reign. Inside Egypt, life reflected that stability. Art flourished, not as rigid symbolism but with softness, realism, and confidence. Faces gained individuality. Bodies showed movement and ease. This was the aesthetic of a society at peace with itself. Religion expanded as well, with Amenhotep III increasingly associated with divine attributes during his lifetime. He was not merely a king chosen by the gods—he was a living manifestation of cosmic order, Ma’at itself embodied in human form. It is no coincidence that his reign is remembered as the golden age. This was the apex—the point at which wealth, culture, spirituality, and global influence aligned perfectly. Everything before led to it. Everything after struggled to live up to it. Even his successors ruled in the long shadow he cast. His son, Akhenaten, would attempt to reshape religion entirely, not from weakness, but from the confidence inherited from a world already conquered by his father. Tutankhamun, whose name eclipsed Amenhotep III in modern popular culture, ruled a diminished echo of that greatness, remembered largely because the artifacts of his burial survived untouched. History, however, has a habit of obscuring African power when it becomes inconvenient. Amenhotep III is often reduced to a prelude, a name mentioned quickly before the so-called “interesting” period begins. But this framing is backwards. There is no later drama without his stability. There is no religious revolution without his wealth. There is no global Egypt without his diplomacy. He is not a footnote—he is the foundation. What makes Amenhotep III truly remarkable is not just what he built, but what he proved. He demonstrated that African civilization could dominate the world without perpetual violence. That wealth could be institutional, not extractive. That culture could be both sacred and luxurious. That leadership rooted in balance, not chaos, could sustain an empire at its absolute height. When Egypt is discussed as a mystery, as a marvel detached from Africa, Amenhotep III stands as a correction. His reign was unmistakably African in origin, power, and identity. The Nile was not a backdrop—it was the engine. The people were not passive laborers—they were participants in a civilization conscious of its greatness. This was not borrowed glory. It was built, refined, and ruled by Africans at the highest level humanity had yet seen. Amenhotep III did not rule during Egypt’s rise, nor its decline. He ruled at the peak—the summit where everything worked. And history has been trying to climb back there ever since. Slug: amenhotep-iii-african-pharaoh-egypt-absolute-peakMeta Description: Amenhotep III was the African pharaoh who ruled Egypt at its absolute peak of wealth, peace, diplomacy, and global power—an unmatched golden age in human history.