How to Start an Emergency Fund (Beginner Guide)

Most people don’t fall into financial trouble because they’re reckless.They fall because life happens. A tire blows out on the highway.Hours get cut at work.A child gets sick.Rent goes up.The car refuses to start on Monday morning. And suddenly a small inconvenience becomes a financial emergency. Here’s the truth many households discover too late: The problem isn’t the emergency.The problem is being unprepared for it. That’s where an emergency fund changes everything. It turns panic into inconvenience.It turns stress into strategy.It gives you breathing room while everyone else is gasping for air. Let’s build yours step by step. What Is An Emergency Fund? An emergency fund is money set aside ONLY for unexpected, necessary expenses. Not vacations.Not shoes.Not a concert. We’re talking about: If it’s not urgent and unexpected, it doesn’t qualify. This money is your financial shock absorber. Why Beginners Must Start Here First Before investing.Before flipping houses.Before crypto.Before options. You need stability. Without a cushion, every surprise gets put on a credit card…and debt quietly becomes the thief of your future wealth. An emergency fund protects your:✔ Credit score✔ Investments✔ Peace of mind✔ Ability to make calm decisions No drama. No desperation. Step 1: Your First Goal → $1,000 Forget six months of expenses for now. Your first mission is simple:stack your first $1,000 as fast as possible. Why? Because most small emergencies fall under that number. And once you hit it, something powerful happens… You start moving different.You feel in control.You breathe easier. Confidence is built through wins. Step 2: Where Should You Keep It? Your emergency money should be: ✅ Safe✅ Easy to access✅ Separate from daily spending Good places include: Not under the mattress.Not invested in stocks.Not tied up where it can lose value. This is protection money, not growth money. Step 3: How Much Do You Eventually Need? After you reach $1,000, level up to: 👉 3–6 months of living expenses. If your monthly bills are $3,000, your target becomes: This is the number that protects families from layoffs, illness, or major life disruptions. Step 4: How To Build It Faster Most people think they can’t save. But usually, money is leaking quietly. Try this: Speed matters. The faster you build it, the faster stress leaves your life. Step 5: Automate Your Discipline Willpower fades. Systems win. Set up automatic transfers every payday — even if it’s only $25 or $50. You’re not trying to be impressive.You’re trying to be protected. Small deposits create big security over time. What Happens When You Finally Have One Something amazing changes. You stop fearing the mail.You stop dreading unknown numbers calling.You stop living on edge. You gain power. Because emergencies no longer control you. You control them. The BD&C Truth About Wealth Most people chase visible wealth. Nice cars.Designer clothes.Status. But real wealth often starts invisibly. In quiet accounts.In boring savings.In preparation. Because when storms hit, the prepared keep moving forward while others start over. If nobody ever taught you this, now you know. Start small.Stay consistent.Protect your household. Your future self will thank you. #EmergencyFund #RainyDayMoney #FinancialSecurity #BlackWealth #GenerationalWealth #MoneyBasics #WealthBuilding #BDandC Focus Keyphrase: how to start an emergency fundSlug: how-to-start-an-emergency-fundMeta Description: Learn how to start an emergency fund step by step. A beginner-friendly guide to building financial security, avoiding debt, and protecting your future. They never told us that peace of mind has a price — and it’s usually saved a little at a time. An emergency fund is more than money; it’s dignity, choice, and the power to say “we’ll be okay.” Start yours today, build it brick by brick, and watch how differently you walk through the world tomorrow. Read more and take control at Black Dollar & Culture.

When America Is in Debt, Ownership Is the Escape Plan

When a nation owes more than it owns, history begins to whisper. There is a moment in every empire’s life when the numbers stop being numbers and start becoming signals. Signals of strain. Signals of fragility. Signals that the ground beneath everyday people is slowly, quietly shifting. The screens still glow. The markets still open. Politicians still promise. But beneath the performance, the ledger is bleeding. And for families without ownership, that bleeding eventually reaches the doorstep. Because when governments drown in debt, they rarely sink alone. They inflate.They tax.They cut.They print.They postpone. But they do not protect you. This is the part they never teach in school, never advertise in campaign speeches, never explain during the evening news. Debt at the top changes life at the bottom. The question is never whether a reckoning comes. The question is who is prepared when it arrives. In times like these, there are always two kinds of people. The dependent and the positioned. The dependent wait. They hope the job holds. They pray prices settle. They assume retirement accounts will recover. They trust systems designed by people who already moved their money. The positioned study patterns. They understand that currency weakens when printing strengthens. They recognize that assets behave differently than wages. They know that ownership absorbs shock while dependency multiplies it. And they move early. Long before panic becomes policy. If you listen carefully, history has run this lesson before. When Rome stretched itself beyond sustainability, elites secured land while citizens received promises.When currencies faltered in Latin America, those with businesses survived while savers were erased.When inflation burned through the 1970s, hard assets outran paychecks. Different centuries.Same story. When the system is stressed, ownership becomes oxygen. Everything else becomes hope. But here is where this becomes personal. For generations, many families were kept from acquiring the very tools that provide insulation during unstable times. Access denied. Loans rejected. Districts redlined. Knowledge hidden behind walls of jargon. The result was predictable. When turbulence comes, those without assets feel it first and longest. So what do you do when the largest economy in the world keeps adding zeros to a bill nobody can realistically repay? You stop playing defense. You start building position. You convert fragile income into durable assets. You prioritize businesses that can raise prices with inflation.You learn how real estate transfers cost to tenants.You understand why equity in productive companies historically survives currency cycles.You build private systems of lending inside families.You turn consumers into shareholders. You become harder to shake. Because the uncomfortable truth is this: Governments respond to debt with policies.Owners respond to debt with strategy. And strategy travels through bloodlines. Some people will read headlines and freeze. Others will read balance sheets and prepare. This is not about fear. Fear paralyzes. This is about awareness. Awareness sharpens. A country carrying enormous debt will make decisions to maintain stability. Some of those decisions help markets. Some hurt workers. Some protect banks. Some dilute savers. But almost all reward ownership. That pattern is as old as finance itself. The people who understand it quietly rearrange their lives. They buy instead of rent.They invest instead of store cash.They create income streams instead of relying on one.They study policy the way farmers study weather. Because storms are inevitable. Preparation is optional. And once you see the pattern, you cannot unsee it. You begin to recognize why the wealthy rush into assets during uncertainty.Why institutions accumulate land.Why smart money prefers control over promises. They are not guessing. They are positioning. So the real conversation is not “Is America in debt?” The real conversation is, “Are we building protection faster than the system is building pressure?” That answer determines comfort or crisis for the next generation. Families who move early will look calm later. Families who wait will wonder what happened. And somewhere in the future, children will ask what decisions were made when the warning signs were visible. They will live inside the answer. History is generous with clues. It is ruthless with excuses. The debt may be national. But preparation is personal. Move accordingly. Focus Keyphrase: America in debt wealth strategyMeta Description: America’s rising national debt is a warning signal. Learn how families can protect themselves through ownership, assets, and generational wealth positioning.Slug: america-in-debt-wealth-strategy

The Safest Place to Keep Your Money During a Crisis

When a crisis hits — recession, banking panic, market crash, political chaos — the first instinct people have is to move fast. Pull money out. Hide cash. Chase whatever feels “safe” at the moment. That instinct has ruined more wealth than the crisis itself. The truth is uncomfortable, but powerful:There is no single “safe place” for money during a crisis. There is only a safe strategy. And the people who come out stronger aren’t the ones who panic — they’re the ones who prepared before the storm. Let’s walk through where money actually survives, grows, and stays accessible when systems get stressed. What “Safe” Really Means in a Crisis Before we talk locations, we need to define safety properly. During a crisis, “safe” does not mean: Safe means three things: Any place your money lives should satisfy at least two of the three. The strongest setups hit all three. 1. Insured High-Yield Cash (Your First Line of Defense) Despite the noise, cash is still king during uncertainty — when it’s parked correctly. Money held in FDIC-insured institutions remains one of the most reliable anchors during turmoil. Federal Deposit Insurance Corporation Why this works Where people mess up BD&C rule:Cash is not for growth — it’s for control. 2. U.S. Treasury Assets (Quiet, Boring, Powerful) When fear hits global markets, institutions don’t panic — they run to U.S. Treasuries. U.S. Department of the Treasury Treasury bills, notes, and money-market funds backed by Treasuries are considered some of the safest financial instruments in the world. Why this works What this isn’t This is storm shelter money — not party money. 3. Diversified Brokerage Accounts (Not Just Savings) Many people think crisis safety means “pull everything out.” Wealthy families do the opposite — they spread exposure. A well-structured brokerage account holding: creates controlled risk, not chaos. Why this works The danger isn’t investing during a crisis —it’s being forced to sell because you didn’t plan liquidity. 4. Hard Assets That Don’t Depend on Banks When trust in systems drops, tangible value matters. That includes: Gold isn’t magic — but it has survived: Why this works BD&C reminder:Hard assets protect wealth between generations — not just between paychecks. 5. The Most Overlooked “Safe Place”: Structure Here’s the part most people skip — and pay for later. The safest money isn’t just where it’s kept.It’s how it’s owned. Families that survive crises often use: Why? Because structure protects against: Money without structure is fragile — no matter where it sits. What Not to Do During a Crisis Let’s be clear. ❌ Don’t pull everything into physical cash❌ Don’t chase “guaranteed” returns❌ Don’t move money based on fear headlines❌ Don’t trust platforms you don’t understand Crises punish speed without strategy. The Real Answer No One Wants to Hear The safest place to keep your money during a crisis isn’t a bank, vault, or asset. It’s a system: That’s how wealth survives storms — and why some families quietly come out richer every time. ❤️ Support Independent Black Media Black Dollar & Culture is 100% reader-powered — no corporate sponsors, just truth, history, and the pursuit of generational wealth. Every article you read helps keep these lessons alive — lessons they never taught us, but always used. If this helped you think differently about safety, share it with someone who’s still being told to “just save more.”We don’t need fear.We need frameworks. Ownership over panic.Structure over noise.Strategy over luck. Focus Keyphrase: safest place to keep your money during a crisisSlug: safest-place-to-keep-your-money-during-a-crisisMeta Description: Learn where to safely keep your money during a financial crisis using a proven wealth strategy that prioritizes protection, liquidity, and long-term stability.

How to Invest in ETFs for Beginners (Step-by-Step)

Most people don’t avoid investing because they’re lazy.They avoid it because Wall Street made it sound complicated on purpose. Charts, jargon, talking heads, and fear — all designed to make everyday people feel like investing is something other people do. People with suits, connections, or insider knowledge. The truth is much simpler. Exchange-traded funds — ETFs — were created so regular people could build wealth without needing to guess the next hot stock, time the market perfectly, or sit in front of screens all day. If you understand the basics and stay consistent, ETFs can quietly do the heavy lifting for you. This guide walks you through exactly how to invest in ETFs as a beginner, step by step. 1. What an ETF Actually Is (Plain English) An ETF (exchange-traded fund) is a collection of investments bundled together into one product that trades on the stock market. Instead of buying one company at a time, an ETF lets you buy small pieces of many companies at once. For example: When you buy an ETF, you’re not betting on one company — you’re betting on entire markets. That’s why ETFs are beginner-friendly: they reduce risk through diversification. 2. Why ETFs Are Ideal for Beginners ETFs solve many of the problems that stop people from investing in the first place. Low CostMost ETFs charge extremely low fees compared to traditional mutual funds. Over time, lower fees mean more money stays in your pocket. Instant DiversificationOne purchase can spread your money across dozens, hundreds, or even thousands of assets. Simple to UnderstandYou don’t need to analyze earnings reports or follow daily stock news. FlexibleETFs can be bought and sold just like stocks during market hours. For beginners, ETFs remove complexity without sacrificing growth. 3. Before You Invest: Set the Foundation Before buying any ETF, handle three basics first. Emergency CushionHave some cash set aside. Even $500–$1,000 helps prevent you from pulling investments out at the wrong time. High-Interest DebtCredit cards charging 20% interest will erase investment gains faster than the market can grow them. Clear GoalKnow why you’re investing. Retirement. Long-term wealth. Financial freedom. The goal determines how aggressive or conservative you should be. Investing works best when it supports your life — not when it creates stress. 4. Choose the Right Type of Account You don’t buy ETFs directly — you buy them through an account. The two main options: Taxable Brokerage AccountBest for flexibility. You can invest, withdraw, and add money anytime. You’ll pay taxes on gains. Retirement Accounts (IRA / Roth IRA / 401k)Designed for long-term wealth. Tax advantages make these powerful if you don’t need the money soon. If you’re unsure, many beginners start with a taxable brokerage and later add retirement accounts as income grows. 5. Understand Risk Without Fear Risk isn’t the enemy — misunderstanding it is. Stocks go up and down. That’s normal. ETFs smooth this volatility by spreading risk across many assets. As a beginner, your biggest risk is not investing at all. General rule: Time reduces risk. Panic increases it. 6. Beginner-Friendly ETF Categories You don’t need dozens of ETFs. Most beginners do well starting with just a few types. Total Market ETFsTrack the entire U.S. stock market. Broad, simple, effective. S&P 500 ETFsFocus on America’s largest companies. Historically strong long-term growth. International ETFsExpose you to markets outside the U.S. for global diversification. Bond ETFsProvide stability and income. Useful as your portfolio grows. Dividend ETFsFocus on companies that pay consistent dividends, offering income alongside growth. You don’t need everything — just balance. 7. How Much Money Do You Need to Start? There is no minimum “wealth level” to begin. Many ETFs allow: What matters is consistency, not size. A small amount invested regularly beats a large amount invested once and forgotten. 8. The Power of Dollar-Cost Averaging Dollar-cost averaging means investing the same amount on a schedule — regardless of market conditions. This approach: Markets reward patience, not prediction. 9. How to Place Your First ETF Trade The mechanics are simple. Once purchased, the real work is doing nothing. Overtrading hurts beginners more than market downturns. 10. How Often Should You Check Your Investments? Not often. Checking daily leads to emotional reactions. Long-term investing doesn’t require constant attention. A healthy rhythm: Wealth grows quietly — not through constant movement. 11. Common Beginner Mistakes to Avoid Chasing hypeIf everyone is talking about it, the opportunity is often already priced in. OvercomplicatingMore ETFs doesn’t mean better results. Selling during downturnsMarket drops are normal. Selling locks in losses. Ignoring feesSmall percentages compound over time — in either direction. Simplicity wins. 12. The Long View: Why ETFs Build Quiet Wealth ETFs don’t promise overnight riches. They promise something better: ownership, participation, and compounding over time. Many everyday investors built wealth not by brilliance, but by staying invested through recessions, booms, crashes, and recoveries. The market rewarded discipline, not drama. This is how wealth is built when no one is watching. Final Thought: Start Small, Stay Consistent You don’t need permission to invest.You don’t need perfect timing.You don’t need expert predictions. You need a plan, patience, and consistency. ETFs allow everyday people to participate in systems once reserved for institutions. Used correctly, they become quiet tools of freedom — growing in the background while you live your life. The best time to start was yesterday.The second best time is today. Focus Keyphrase how to invest in ETFs for beginners Slug how-to-invest-in-etfs-for-beginners Meta Description Learn how to invest in ETFs for beginners with this step-by-step guide from Black Dollar & Culture. Understand ETFs, reduce risk, and build long-term wealth with confidence.

How Banks Decide Who Gets Rich (And Who Stays Stuck)

Most people believe banks reward hard work, intelligence, or high income.They don’t. Banks reward behavior, predictability, and positioning inside the financial system. Long before wealth appears on the surface, banks have already classified individuals based on how they interact with money under pressure. This classification quietly determines who gets access, flexibility, and leverage — and who remains constrained. Let’s break it down step by step. 1. Banks Don’t See People — They See Risk Profiles Banks do not evaluate character, effort, or personal stories.They evaluate risk profiles. A risk profile is built from data: This data answers one core question:Is this person a liability or an asset? Someone can be intelligent, hardworking, and well-intentioned and still be labeled high risk if their profile shows inconsistency. Banks are not emotional. They respond to patterns. 2. Predictability Is More Valuable Than Income Income matters, but it is secondary. Predictability tells banks how someone behaves when money is tight. A person earning $60,000 who pays consistently, keeps balances low, and avoids volatility often receives better terms than someone earning $120,000 who lives at the edge of their limits. From a banking perspective: Banks lend other people’s money. Their goal is not generosity — it is certainty. 3. Credit Scores Measure Trust, Not Wealth A credit score is not a wealth indicator.It is a trust score. Banks use it to estimate: Every on-time payment slightly increases trust. Every missed payment tightens restrictions. Over time, these small signals accumulate into major differences in access. Trust compounds quietly. 4. Utilization Signals Dependence or Control How much credit someone uses compared to what they have available matters deeply. High utilization communicates one thing:Dependence on borrowed money. Low utilization communicates another:Access without desperation. Banks prefer borrowers who can borrow but don’t need to. This signals control, planning, and restraint — all qualities associated with lower default risk. 5. Banks Reward Good Behavior Indirectly Banks rarely announce when someone moves into a stronger category. Instead, the system responds subtly: People who stay stuck often think these advantages are reserved for others. In reality, they are responses to long-term behavioral patterns. Nothing dramatic happens.The rules simply loosen. 6. How Money Enters the System Changes Everything Earned income enters the financial system at a disadvantage. Taxes are removed immediately, and spending decisions are made with what remains. Ownership income enters differently. Businesses and asset holders touch money before expenses and taxes are finalized. This creates flexibility, write-offs, and control. From a bank’s perspective, control equals leverage. This is why two individuals earning the same amount can live entirely different financial lives. 7. Reactive Behavior Keeps People Stuck People who remain financially constrained often interact with banks reactively: This behavior keeps them visible as risks rather than participants. Banks do not punish this behavior.They simply do not reward it. 8. Strategic Positioning Changes Outcomes People who gain leverage interact with banks intentionally: They treat credit as a tool, not an emergency resource. Over time, this positioning shifts how the system responds to them. The system opens gradually — not suddenly. 9. Banks Don’t Decide Who Deserves Wealth This is where most people misunderstand the process. Banks do not decide who deserves to be wealthy. They decide who can handle leverage without collapsing under pressure. Their decisions are based on data, not judgment. Once this is understood, the goal changes: This shift is where access begins. 10. Wealth Is Authorized Before It Is Visible By the time wealth appears publicly, approval already happened quietly. Lower interest rates.Higher limits.Easier capital access.Room to recover from mistakes. These advantages are granted long before success is visible. Wealth is not random.It is authorized through behavior repeated over time. Final Word Banks do not create wealth.They gatekeep leverage. They decide who gets flexibility and who remains constrained based on predictable behavior, not effort or intention. Once you understand how banks think, the strategy becomes clear:position yourself as stable, disciplined, and low risk with long-term upside. That is how people stop being managed by the system and start operating within it. That is how people move from stuck to scalable. Focus Keyphrase How banks decide who gets rich Slug how-banks-decide-who-gets-rich-and-who-stays-stuck Meta Description Banks don’t reward hard work or income alone. This step-by-step breakdown explains how banks decide who gets access to leverage, lower rates, and wealth-building opportunities—and who stays financially stuck.

How Trusts Protect Assets From Lawsuits (And Why Most People Get It Wrong)

Most people believe that once assets are placed into a trust, they are automatically protected from lawsuits. That belief sounds comforting—but it’s often dangerously incomplete. Trusts can protect assets from lawsuits, but only when they are structured correctly, implemented early, and paired with the right legal principles. Otherwise, a trust may offer little more than a false sense of security. Asset protection is not about hiding money. It’s about changing ownership, limiting control, and placing legal distance between you and potential claims—before problems arise. To understand how trusts actually work in this context, we need to start with how lawsuits really take assets. When a lawsuit is filed and a judgment is entered, the opposing party is not looking for effort, intention, or fairness. They are looking for what you legally own and what you legally control. Bank accounts, real estate, investment accounts, business interests, and income streams are all evaluated through this lens. If an asset is considered yours—either because your name is on it or because you can freely access and control it—it may be reachable. This is where trusts come in, but not all trusts function the same way. A trust works by separating three roles: the person who creates the trust (the grantor), the person who manages the trust (the trustee), and the person who benefits from the trust (the beneficiary). Asset protection becomes possible when these roles are structured so that the grantor no longer has direct ownership or unrestricted control. In other words, protection comes from distance, not paperwork. One of the most common mistakes people make is assuming that a revocable living trust provides lawsuit protection. Revocable trusts are popular because they are flexible—you can change them, cancel them, and move assets in and out at will. However, from a lawsuit perspective, that flexibility is the problem. If you retain the power to revoke the trust or freely reclaim the assets, a court may still treat those assets as yours. In many cases, revocable trusts offer little to no protection from creditors. Irrevocable trusts operate differently. While “irrevocable” does not mean untouchable, it does mean that the grantor gives up certain rights and powers. That loss of control is precisely what can create asset protection. When structured properly, an irrevocable trust can place assets outside the grantor’s personal ownership, making it significantly more difficult for a creditor to reach them. Several mechanisms inside a trust determine whether it actually protects assets. One is legal ownership. If the trust, not the individual, owns the asset—and the individual cannot unilaterally reclaim it—that asset may be insulated from personal lawsuits. Another mechanism is the spendthrift provision, which can limit a beneficiary’s ability to transfer or pledge their interest and may restrict a creditor’s ability to force distributions. Trustee discretion also matters. When distributions are controlled by a trustee and not guaranteed on demand, creditors often face additional legal barriers. Timing is critical. Asset protection is strongest when trusts are established before there is any known claim, dispute, or legal threat. Moving assets into a trust after being sued—or after anticipating a lawsuit—can trigger fraudulent transfer laws. Courts have the power to reverse those transfers, effectively undoing the protection and potentially making the situation worse. This is why asset protection is about planning, not panic. Trusts are often used in combination with other protective tools. Real estate, for example, may be owned by an LLC to contain liability, with the ownership interest of that LLC held by a trust. Business interests may be structured so operational risk stays separate from personal wealth. Investment accounts can be titled in the name of a trust depending on the overall strategy. In each case, the trust is not the only line of defense—it is part of a layered system. The most common reason trusts fail in court is simple: too much control. When the same person is the grantor, trustee, and beneficiary—and can revoke the trust at any time—the legal separation collapses. Courts are not obligated to honor structures that exist in form but not in substance. Real protection usually requires real boundaries, sometimes including an independent trustee and clearly defined limits on access. From a BD&C perspective, trusts should be viewed as ownership tools, not magic shields. True protection comes from layering: reducing risk through smart behavior, transferring risk through insurance, containing risk through entities like LLCs, and then structuring ownership through trusts. Each layer reinforces the others. Trusts can protect assets from lawsuits—but only when they are built deliberately, early, and correctly. Wealth is not just about what you earn. It’s about what you can keep, control, and pass forward. Understanding how trusts really work is part of moving from income thinking to ownership thinking. This article is for educational purposes only and does not constitute legal advice. Asset protection strategies vary by jurisdiction, and qualified legal counsel should be consulted for individual circumstances. If you wait until risk shows up, it’s already too late. Asset protection only works before courts, creditors, or claims enter the picture. An Irrevocable Life Insurance Trust (ILIT) is one of the few tools that can legally remove life insurance from your estate and protect it from lawsuits — but only if it’s structured correctly. This guide breaks down exactly how ILITs work, when to set them up, and the mistakes that quietly expose families every day. Read the ILIT Guide now and secure the structure while you still control the outcome → Get Your Family Wealth Trust Blueprint Now Historically, the families who preserved wealth didn’t do it by reacting to threats—they built systems before threats ever appeared. Ownership structures, trusts, and layered protection weren’t accidents; they were deliberate moves. If you want to continue learning how real wealth is protected and transferred, explore more at Black Dollar & Culture and start building with intention, not urgency. Focus Keyphrase How trusts protect assets from lawsuits Meta Description Learn how trusts protect assets from lawsuits, why revocable trusts often fail, how irrevocable

Elijah McCoy: The Black Inventor Whose Genius Became the Standard for the World

Elijah McCoy was born into a nation that benefited from Black intelligence while refusing to honor it. The son of formerly enslaved parents, McCoy entered a world where freedom existed on paper, but opportunity did not. Yet even inside that reality, his mind operated on a level so advanced that the industrial world was forced to adapt to him—even while trying to erase his name. From an early age, McCoy displayed a rare mechanical brilliance. His parents, recognizing what they had, made an extraordinary sacrifice and sent him to Scotland to study mechanical engineering. At a time when most Black Americans were barred from formal education, McCoy became fully trained in the science of machinery, precision systems, and industrial mechanics. He returned to the United States prepared to work as an engineer—but America refused to let him be one. Instead, McCoy was hired as a railroad fireman and oiler, jobs far beneath his qualifications. But what appeared to be a demotion became an advantage. Inside the belly of the industrial machine, McCoy observed a problem no one else was equipped to solve. Steam engines powered the economy, but they were inefficient. They had to be stopped repeatedly so workers could manually lubricate moving parts. Every stop meant lost time, wasted money, and reduced productivity. McCoy saw the flaw clearly—and he fixed it. He designed an automatic lubrication system that allowed engines to oil themselves while running. Machines no longer needed to shut down. Railroads ran longer. Factories became more efficient. Heavy machinery gained endurance and reliability. His invention quietly transformed industry, setting a new standard for how machines should operate. The impact was immediate and undeniable. McCoy’s lubrication systems were so effective that inferior copies flooded the market. But engineers and buyers quickly learned the difference. They refused substitutes. When ordering equipment, they demanded only the authentic design. They wanted the real McCoy. That phrase—now used worldwide to describe authenticity and excellence—was born directly from the work of a Black inventor whose name history often omits when repeating it. Over his lifetime, Elijah McCoy secured more than 50 patents, many centered on lubrication systems, mechanical efficiency, and industrial improvement. Yet like so many Black innovators, he struggled to benefit financially from his own brilliance. Racism blocked access to investors, manufacturers, and ownership opportunities. Corporations and industries thrived using systems inspired by his ideas, while McCoy himself lived without the wealth his inventions generated. Still, his legacy could not be denied. Every modern engine designed for continuous operation carries his influence. Every industrial system built to reduce friction, prevent failure, and maximize efficiency reflects his thinking. McCoy did not simply invent devices—he defined reliability itself. His life exposes a larger truth: Black inventors were not behind progress. They were ahead of it. They built the backbone of modern industry while being denied credit, capital, and protection. Elijah McCoy’s genius was so undeniable that the world immortalized his name as a guarantee of quality—even while refusing to properly honor the man behind it. Elijah McCoy is not a footnote. He is a foundation. And understanding his story is not just about the past. It is about reclaiming the truth of who built the systems that still power the world today. 🔑 Focus Keyphrase Elijah McCoy Black Inventor 🔗 Slug elijah-mccoy-black-inventor-real-mccoy 🧾 Meta Description Elijah McCoy was a revolutionary Black inventor whose engineering genius transformed the Industrial Age and inspired the phrase “the real McCoy,” now a global symbol of authenticity and excellence.

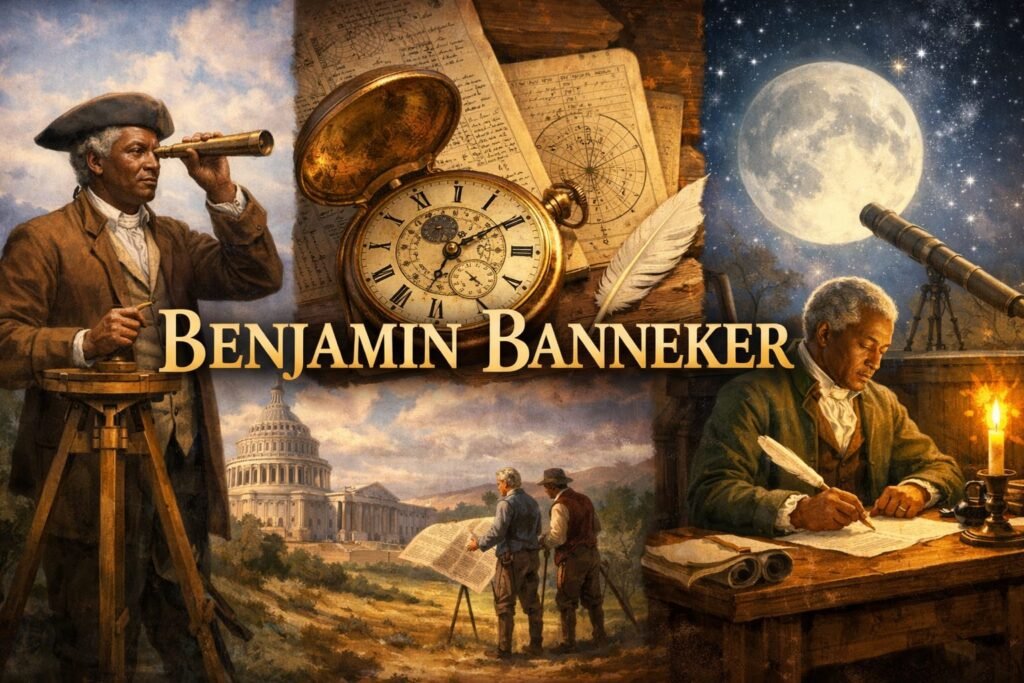

Benjamin Banneker: The Man Who Measured the Stars and Helped Build America

Benjamin Banneker was born in 1731 in rural Maryland, at a time when knowledge was tightly controlled and opportunity was rationed by class, race, and access. He was born free, yet freedom in colonial America did not include schools, institutions, or formal pathways into science or public life. What Banneker possessed instead was an uncommon discipline of mind, a relentless curiosity, and the ability to teach himself in a world designed to exclude him. From an early age, Banneker demonstrated a deep attentiveness to patterns. He observed the movement of shadows, the rhythm of seasons, the cycles of the moon, and the quiet logic underlying numbers. These observations were not passive. They became the foundation of a rigorous self-education in mathematics, astronomy, mechanics, and natural philosophy. Without classrooms or instructors, he relied on borrowed books, correspondence, and repeated experimentation. Knowledge, for Banneker, was not inherited or granted — it was earned through persistence. One of his earliest achievements revealed the breadth of his mechanical intelligence. After examining a pocket watch, Banneker constructed a fully functional wooden clock entirely by hand. At a time when precision timekeeping was rare and highly specialized, his clock reportedly kept accurate time for decades. This was not novelty craftsmanship. It was applied engineering — a synthesis of measurement, geometry, and mechanical reasoning executed with remarkable precision. Banneker’s attention soon turned upward to the night sky. Astronomy in the eighteenth century demanded advanced mathematical ability, extended observation, and exact calculations. Without formal training, Banneker mastered celestial mechanics well enough to calculate planetary positions, track lunar cycles, and accurately predict eclipses. These were not theoretical exercises. They became published data used by others. Between 1791 and 1796, Banneker authored and published a series of almanacs containing astronomical calculations, weather forecasts, tide tables, and practical information essential for farmers, navigators, and merchants. Almanacs were critical tools in early American life, shaping agricultural planning and commerce. Banneker’s editions were valued for their accuracy and circulated widely throughout the Mid-Atlantic region. His work entered daily life quietly, efficiently, and without spectacle. It was this reputation for precision that brought Banneker into one of the most consequential projects of the young nation: the surveying of the federal district that would become Washington, D.C. In 1791, he was appointed as an assistant to the survey team responsible for mapping the boundaries of the future capital. Using astronomical observations and mathematical calculations, Banneker helped establish the layout of the city. According to historical accounts, when the original design plans were lost following the departure of the chief planner, Banneker reproduced the layout from memory — an extraordinary demonstration of spatial reasoning and intellectual command. At the same time, Banneker understood that knowledge carried moral responsibility. In 1791, he wrote a carefully reasoned letter to Thomas Jefferson, then Secretary of State, addressing the contradiction between Jefferson’s stated belief in liberty and his participation in slavery. Banneker did not rely on rhetoric alone. He appealed to logic, evidence, and shared Enlightenment principles. Enclosed with the letter was a copy of his almanac — not as a plea for validation, but as proof of intellectual equality grounded in demonstrable work. Jefferson responded respectfully and forwarded Banneker’s almanac to intellectual circles in Europe. Yet the system itself remained intact. Still, the exchange endures as one of the most direct intellectual challenges to slavery issued during the early republic — a reminder that resistance did not always take the form of protest, but often appeared as clarity, data, and moral precision. Banneker lived the remainder of his life quietly. He never married, never accumulated wealth, and never sought public acclaim. In 1806, after his death, much of his work was lost in a fire that consumed his home. What survived did so unevenly — scattered across letters, publications, and partial historical records. Over time, his role in the nation’s formation was minimized, simplified, or omitted altogether. Yet Benjamin Banneker cannot be reduced to a symbol or an exception. He was a builder of systems, a producer of usable knowledge, and a contributor to the physical and intellectual infrastructure of the United States. His life stands as evidence that disciplined thought does not require permission, and that nation-building has always depended on minds history later chose not to emphasize. To study Benjamin Banneker is to confront a deeper truth about America’s origins: that progress was shaped not only by those whose names dominate monuments, but by thinkers whose work spoke for itself long before recognition followed. His legacy is not confined to clocks, almanacs, or survey lines. It is the enduring reminder that knowledge, once proven, cannot be erased — only delayed. Focus Keyphrase:Benjamin Banneker Washington DC Slug:benjamin-banneker-washington-dc Meta Description:Discover the true story of Benjamin Banneker, the self-taught polymath whose astronomical calculations and surveying work helped shape Washington, D.C., and challenged the contradictions of America’s founding ideals.

Why Your Paycheck Is the Least Important Part of Your Financial Life

Most people believe the key to financial security is earning more money. A bigger paycheck. A raise. A promotion. Another side hustle. And while income matters, this belief hides a dangerous truth: A paycheck is not wealth. It’s just a tool. If your entire financial plan depends on a paycheck continuing forever, you don’t have stability—you have exposure. And the system understands this far better than most people do. This is why some households earn six figures and still struggle, while others earn less but quietly build lasting wealth. Let’s break down what really matters. 1. A Paycheck Is Temporary by Design A paycheck depends on factors you don’t fully control: No matter how good the job is, a paycheck only exists as long as someone else allows it. Wealth, on the other hand, is designed to function without your daily presence. That’s the first major distinction most people are never taught. 2. Banks Don’t Respect Income — They Respect Structure Here’s something the system doesn’t advertise: Banks don’t analyze you emotionally.They analyze you structurally. They look at: A high income with no structure is treated as fragile.A modest income with assets, reserves, and discipline is treated as stable. This is why two people earning the same amount can be treated completely differently by financial institutions. 3. Income Is Fuel — Not the Destination Think of your paycheck like gasoline. Gas is necessary, but nobody confuses gas with the vehicle. Your paycheck should be used to: If all of your income is consumed by lifestyle, bills, and survival, then your paycheck is doing exactly what the system expects it to do: keep you running, but never arriving. 4. Ownership Outlives Effort Here’s the uncomfortable truth: You can work hard forever and still pass down nothing. Ownership is what survives: This is why wealthy families talk about control, not just cash. Cash gets spent. Control compounds. When income stops, ownership continues. 5. The Real Risk Is Dependency, Not Low Income Low income can be improved.High dependency is dangerous. If missing two paychecks would collapse your life, the issue isn’t how much you earn—it’s how exposed your financial structure is. True financial growth focuses on: Wealth isn’t loud. It’s resilient. 6. A Simple Shift That Changes Everything Instead of asking: “How can I make more money?” Start asking: “How can I make my money less necessary?” That question changes how you: This is where real financial freedom begins—not with hustle, but with intention. Final Thought Your paycheck is important—but it was never meant to be the foundation of your financial life. It’s a tool.A bridge.A starting point. The goal isn’t to earn forever.The goal is to build something that no longer requires permission. And once you understand that, you stop chasing money—and start designing stability. 📣 Keep the Conversation Going If this perspective shifted how you think about money, share this with someone who’s grinding but not building. Then explore more wealth-building strategies at Black Dollar & Culture, where we focus on ownership, structure, and legacy—because no one is coming to save us, and we don’t need them to. #BlackDollarCulture #FinancialLiteracy #WealthMindset #OwnershipEconomy #GenerationalWealth #FinancialFreedom #BuildTheBlock #QuietWealth #MoneyEducation #EconomicEmpowerment Focus Keyphrase: why paycheck is not wealthMeta Description: Most people chase bigger paychecks while ignoring ownership, structure, and control. Learn why income is the least important part of real wealth.Slug: why-your-paycheck-is-not-wealth

Why One Missed Payment Changes How Banks See You (Most People Don’t Know This)

Most people think a missed payment is a small mistake. An accident. Something you can “catch up on next month.” But inside the financial system, a missed payment is not treated as an accident at all. It is treated as a signal. Not a loud signal. A quiet one. And quiet signals are often the most dangerous, because you don’t feel the damage immediately — but institutions adjust their behavior toward you long before you realize anything has changed. When a payment is missed, banks don’t ask why. Credit bureaus don’t care about context. Algorithms don’t measure intent. They measure behavior. One late payment tells the system something very specific: reliability has shifted. That shift doesn’t always show up as an immediate credit score collapse. In fact, that’s what makes it deceptive. Many people check their score after a missed payment and feel relieved. “It didn’t drop that much,” they say. But scores are only the surface layer. Beneath that number is a behavioral profile that lenders study far more closely than most people realize. Banks track patterns, not apologies. A missed payment introduces friction into your financial reputation. It changes how future decisions are made about you. Credit limits. Approval speed. Interest rates. Even which offers you’re allowed to see. You may never receive a rejection letter that says, “We noticed that one time you slipped.” Instead, you’ll experience something subtler: higher costs, slower approvals, fewer second chances. This is where people misunderstand the system. They believe recovery is immediate once the balance is paid. But trust, once dented, doesn’t snap back into place. It rebuilds slowly, over time, through consistency — not explanations. Financial institutions are not emotional. They are statistical. A single missed payment tells the system you are capable of disruption. And from a lender’s perspective, risk is not about how often something happens. It’s about whether it can happen again. That’s why two people with the same credit score can be treated very differently. One may have a clean behavioral record. The other may have a single late mark buried in their history. On paper, they look equal. In practice, they are not. This is also why missed payments matter more during certain windows. Early in a credit relationship, a missed payment weighs heavier. During periods of economic tightening, it weighs heavier. When interest rates are high and capital is cautious, lenders become less forgiving — not more. Timing amplifies consequences. The most dangerous part is that missed payments often happen during stress — illness, job changes, emergencies. Exactly when people are least equipped to absorb additional financial pressure. The system doesn’t pause during hardship. It documents it. That documentation follows you quietly. And while most people focus on “fixing” the missed payment, the more important move is preventing the next one. Systems reward predictability above all else. Autopay, buffers, conservative limits — these aren’t convenience tools. They’re defensive strategies. Wealthy households don’t rely on memory. They rely on systems. They assume life will interrupt. They assume distractions will happen. And they build financial structures that protect their reputation even when attention slips. Because they understand something most people are never taught: your financial reputation is more valuable than your money. Money can be replaced. Trust takes time. This is why a missed payment is not just a late fee. It’s not just interest. It’s a data point that lives in places you don’t see, influencing decisions you didn’t know were being made. The warning isn’t dramatic. It’s quiet. But it’s major. Understanding this changes how you move. It changes how you set up accounts. It changes how seriously you treat “small” delays. Because once you understand how the system thinks, you stop treating missed payments as minor mistakes — and start treating them as avoidable signals. Signals that decide how expensive your future becomes. Focus Keyphrase: missed payment financial warningSlug: missed-payment-major-warningMeta Description: A missed payment is more than a mistake—it’s a signal to banks and lenders. Learn how one late payment quietly changes your financial reputation and future costs.